Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Pop quiz time! According to MTG Stocks, which printing of Winds of Change is the most expensive? The answer may surprise you...

If you guessed the black-bordered, original Legends printing, I don’t blame you. That seems like the most logical guess. What isn’t logical is that, if you want to purchase the cheapest English Winds of Change copy on TCGPlayer, you’d be buying a heavily played Legends copy. That’s right, the Legends copies available for sale start at the lowest price.

This trend is bizarre indeed, and there are other cards with similarly surprising pricing differentials. This week I'll explore the latest rounds of buyouts and my thoughts on why we’re seeing certain printings outshine others.

White Border Buyouts

Generally not known for their aesthetics, white-bordered cards are often considered the budget-friendly printings of a given card. This is because the vast majority of cards are black-bordered and players often prefer all the borders in their deck match. Additionally, white-bordered cards come from sets with massive print runs (excluding Unlimited).

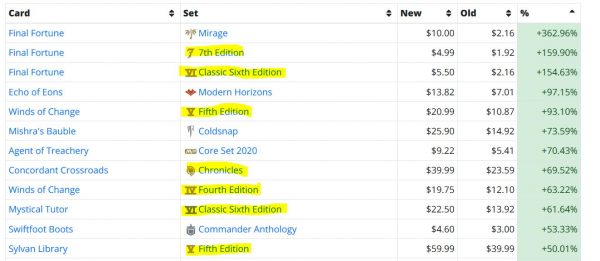

So when I looked up the largest movers on MTG Stocks this week and saw that seven white-bordered cards jumped more than 50% over the past week, I was dumbfounded.

Final Fortune, Winds of Change, Concordant Crossroads, Mystical Tutor, and Sylvan Library are all-powerful cards, don’t get me wrong. I’m sure there are logical explanations for their sudden surge in price. What’s harder to explain is the relative movement of these cards across their various print runs.

It looks like all printings of Final Fortune are on the rise—I don’t know why, but they are—and it’s reassuring to see each printing is up and the black-bordered Mirage printing is the most valuable. This follows the typical assumptions around border colors.

Winds of Change copies, on the other hand, seems to have spiked most if they were from Fifth Edition or Fourth Edition. Legends copies also jumped but they moved just 47% vs. the 93% and 63% jumps of the two white-bordered printings.

This isn’t a one-card trend, either. Take a look at Concordant Crossroads. The Chronicles printing jumped nearly 70% last week, rising from $23 to $40 on MTG Stocks.

Before the spike, the Legends printing of this green enchantment was about five times more expensive than its white-bordered counterpart in Chronicles. Now that Chronicles copies are $40 and Legends copies haven’t moved, that ratio is cut in half to just 2.5 times. Suddenly the premium for Legends copies is not so steep.

Mystical Tutor is another example of this anomaly. Sixth Edition copies jumped 61% to $22.50 on MTG Stocks this week. Eternal Masters copies also show up on the Interests page, having risen 34% to $20 this week. Mirage copies, the original printing, were up just 15% this week and are now worth $15. If you wish to purchase the cheapest copy available on TCGPlayer, you’d be buying the original, black-bordered Mirage printing.

Lastly, Sylvan Library is also on the move. But the copies that have moved most over the past week aren’t the versions you’d expect. Fifth Edition copies rose the most, jumping from $40 to $60 according to MTG Stocks (50%). Fourth Edition copies rose from about $40 to $50, a roughly 20% increase. Eternal Masters copies rose from $45 to $50, roughly 10%. Legends copies haven’t moved at all.

Once again, I’m left scratching my head as I try to figure out why the allegedly least popular printings jumped the most in price. If Fifth Edition copies increased 50%, shouldn’t Legends copies have increased by about that much? Minimally I would have expected Eternal Masters copies to jump proportionally given it’s a newer card with an updated frame and rules wording. Yet now it appears you have to pay a premium for a Fifth Edition copy! What gives?

Some Explanation

While some of these moves are perplexing, I believe to an extent they are explainable.

For instance, it’s logical that a more expensive card wouldn’t jump the same percent as a cheaper printing should there be a market-wide adjustment of price. For one, if there is a sudden surge in demand for a card, it’s not surprising that the cheapest copies sell first. A $10 card only needs to increase by $10 to double in price, whereas a $50 printing of that same card would need to increase five times as much for the same percentage increase.

Since MTG Stocks is reporting growth based on percent, it stands to reason that cards with lower bases can grow the largest percent.

The second explanation involves how MTG Stocks pulls its data from TCGplayer. I believe the pricing is based on an average value of lightly played and/or near mint printings of a card. As the copies with nicer condition sell out, the price appears to spike. This is true even if heavily and moderately played copies are passed over. If we use market price instead of MTG Stocks’ default, we see a trend that makes a little more sense. For instance, the Mystical Tutor printing with the lowest market price is Sixth Edition ($11.63) followed by Mirage ($13.59). In this case, the white-bordered printing is indeed the cheapest.

The same trend exists with Winds of Change: the lowest market price by far is the Fourth Edition printing, at $9.40. The Legends printing is nearly twice at, at $16.79. This indicates that while the Fourth Edition printing may have “spiked” the most, actual sold copies are not reflecting the same movement. It’s more likely that sellers are pulling their copies and/or re-listing at a higher price in response to the recent jump in demand, inflating the price reflected on MTG Stocks.

Lastly, we need to consider a card’s rarity from each respective set it was printed in. Sylvan Library was printed as a rare from every set except for its original Legends appearance, where it was an Uncommon. Surely less Legends product was printed than Fifth Edition. But if copies appeared in Legends at three times the rate, that does close the print run gap a decent amount.

I believe this may be the smallest factor, however. After all, there are 58,000 copies of each U1 uncommon printed from Legends. Meanwhile, there are 353,500 copies of each Fourth Edition rare. The numbers aren’t even close despite the disparity in rarity for Sylvan Library.

Wrapping It Up

At a quick glance, it appears certain cards are spiking. That’s nothing new. What’s different this time is that it appears the historically less desirable, white-bordered printings of certain cards are disproportionately rising relative to their black-bordered counterparts.

While MTG Stocks is a valuable resource to check daily, I believe in this case the website is only telling part of the overall story. It’s safe to say Final Fortune, Mystical Tutor, Winds of Change, and Sylvan Library are all on the move. But I’m not about to declare a newfound, white-bordered Renaissance. There’s more to this move.

For starters, a higher starting price means a comparable jump in price is reflected by a lower percentage gain. That’s just basic arithmetic. And while it’s easy to simplify comparisons and argue the more expensive card should jump by that proportionate amount, I believe the newfound demand is for cheaper copies of these cards. Not every Commander player is willing to shell out $100 for a Legends copy of Sylvan Library, after all.

Looking one level deeper, MTG Stocks may be revealing a little bit of (intentional or unintentional) price manipulation on TCGplayer. If sellers are pulling their copies or relisting them at a higher price, it’ll show a jump in price even if copies aren’t actually selling at the new price. That’s how we get such wide spreads between TCGplayer’s standard pricing and its market pricing.

These factors all help explain the perplexing trend. It’s hard to argue that these cards aren’t on the rise—it’s clear they are suddenly in more demand. But it’s much easier to convince ourselves that just because MTG Stocks shows Fifth Edition and Sixth Edition copies are jumping the largest percent doesn’t mean they’re suddenly the most desirable printings. This connection should not be made so readily. There’s much more underlying data that should be inspected before concluding one way or the other.

In these cases, I’ve concluded the cheapest copies are playing some catch-up relative to their most expensive counterparts. But all printings of these cards are rising in demand. Once the dust settles and copies come back into the market, we’ll see the directional trends between printings that we’re used to seeing. This is just a momentary blink, driven by an artifact in how pricing is calculated.

I enjoyed reading this piece, especially the Wrapping it up section. Great real world psychology application.