Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

Everyone has cards they especially like. For some people, it's for flavor reasons, others sentimentality, while some don't really know why they like a card. Personally, I collect the ubiquitous Shivan Dragon. When I first started playing, I was told it was a crap rare, so naturally, I took a liking to it. I have around 40 copies lying in a binder, from almost every printing since Fourth Edition. I would never expect this card to rise in price, save for the earliest printings. Whenever I find a pile of Shivan Dragons, I buy the whole pile. This is not an investment, I just like the card, and I treat my purchases as such.

The Purpose of Purchasing

When you buy cards. they serve one of three purposes, Sentimental/Emotional value, Investment Value, or Playing Value. I will only be talking about two of these archetypes, as buying as a player does not affect this analysis. However, as an investor, you will take into account the other two. Not only should you know the difference between the two, but you should truly understand how these mentalities play into your financial decisions. This will help you gain better self-control and a better understanding of not only your decisions but the decisions of others.

Sentimental/Emotional Value

When you buy a card you like, that is an emotional purchase. You spent money on that card because it simply feels good to own that card. That is not necessarily a bad thing. Depending on the funds you have available to you, and the purpose those funds are allocated for, this could be great. These purchases have intangible value, like providing a feel-good moment when you are flipping through your binder or a good conversation piece at FNM. These are arguably great purchases, but should never be grouped with your investments.

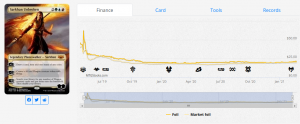

I've made the mistake of purchasing something because I like it, with the self-justification of "It'll go up eventually, it has to". A great example is some of the Mythic Edition Planeswalkers. I picked up Ral, Izzet Viceroy, and Sarkhan Unbroken, both in their foil borderless frame. I bought these under the guise of investment; however, I really just liked the look of the Mythic Edition cards. The price has stayed flat for a very decent portion of time, and I decided it was a ship I could sail another day.

To my dismay, the price was not nearly as good as I hoped it would be, despite my speculation on the limited supply on the secondary market.

Investment Value

As you go to checkout on an online retailer, after spending a sizable amount of time analyzing Reserved List speculations or looking at promising Standard brews, you are making an investment in an asset. The whole point is that you will make money on the sale of that investment. When you do this, you want to reduce the risk of loss to a minimum and spend time making sure your hopeful speculation is realistic.

If you don't make money on this investment, it is dead. You lost money, and likely won't get all of it back if any at all. After all, with how volatile the MTG market is, a dead asset lying in inventory could be detrimental. If you have limited resources, one bad speculation can mark the beginning of the end.

How to Tell if Your Investment Is Emotionally Fueled

The short answer is: you can't. Not consistently anyway. You can narrow it down, however.

If you like a card, that doesn't mean it can't be a smart investment. If you have data to back up your claims and predictions, it doesn't particularly matter if you like the card. You just have to make sure that you are separating those lines of thinking, and acting according to logical reasoning, which sounds straightforward and easy, but I have seen many amateur investors fall, become disinterested, or run out of funds, simply because they did not form a clear barrier between emotions and business. You will blur that line, but minimizing that risk is crucial when every dollar counts. Making one right decision can make the difference between a successful, or a failing business.

The Takeaway

Everyone here is human, and humans make mistakes. They are flawed and imperfect compared to high-powered analytical computers used to analyze market trends. The one advantage we have is also our greatest weakness. We associate ideas or values with certain things, and it is incredible, and beyond what any fancy supercomputer is able to achieve (at the moment). This provides us with an ability to find connections that may not make sense to a computer, the most important of these connections is human psychology.

People act on instinct and emotions. Primal feelings still drive us every day. Human objective thoughts, while relatively objective, still are influenced by these instincts. If one can understand even a one-millionth of how your fellow humans think and feel, then you may just have a leg up on the competition. If you don't, you may just fall victim to your own human psychology. Everyone has their forte, and analyzing the psyche of the market may be the path to success for some; others might rely on objective financial data, everyone will interpret that data differently.

Even if psychological analysis isn't your thing, it's good to have a rudimentary understanding. Ultimately, do what feels good. Whether that be acting on pure instinct alone, or analyzing every small movement of the market. Most of the time, you will reap what you sow. But if you get lucky, you might just have the right seed to succeed. Be careful, make good decisions, and invest in cardboard game cards.