Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

For anyone who's been watching the market recently may have noticed that sometime in the last couple of weeks there was a major anomaly in prices for a number of cards. Shivan Dragon and certain Tempest Medallions being the cards affected, it raises the question, why?

These cards jumped astronomically in price, for seemingly no reason. Some may suggest that it may be a push on simply "old-school" cards, but I'd beg to differ. I'd like to propose a hypothesis, that these cards were not bought out because of nostalgia or supply issues, but because of misprints.

Fifth Edition Copyright Misprints

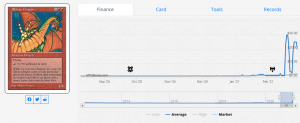

In Fifth Edition there was an issue with the copyright text on five red cards. There was Portuguese text, where the words "All Rights Reserved" were supposed to appear in English. While there are five total cards that this misprint occurs on, the only one to receive a spike was Shivan Dragon. This is likely because of the appeal of a more iconic card, making offloading these cards easier. More people know about the dragons of Shiv than the Game Of Chaos.

I was told by a source within the misprint collecting community that the misprint itself is a semi-standard misprint that affected five red cards on the rare sheet of Fifth Edition. This essentially just means for us that while the misprint is being sought after, it is relatively common. It is likely that these collectors are trying to sort out the wheat from the chaff, and then likely dump the rest back onto the market. Because of this, I believe that the prices will not hold. There has already been considerable volatility in the market, and drops to pre-buyout prices have happened at least once.

Shivan Dragon prices over the last six months

Charlie Brown Medallions

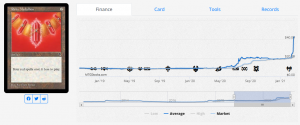

The Medallion cycle from Tempest has always been very interesting in the misprint community. A portion of Tempest Medallions had a remnant of a Charlie Brown comic panel printed lighted over the card's art. Similar to the Fifth Edition misprints, this is often not noticed by sellers and not categorized separately from the normal printings. The price before the buyouts was already hanging around $20. In turn, these cards went up a LOT for all medallions except for Emerald Medallion and Pearl Medallion, which are the cheapest cards in the cycle.

This appears to be a deliberate attempt to sort the misprints out from their counterparts. This may explain why the cheaper Medallions weren't targeted, as buying out the already high versions, stands to bring higher gains. With Jet Medallion and Ruby Medallion rising to $40 each, and Sapphire Medallion holding at almost $90. These might have a chance at staying well above pre-buyout prices, as they already held significant value. This disruption might turn to be a little more than just that.

Charlie Brown misprint as shown on Emerald Medallion

Price history for Ruby Medallion

Price history for Sapphire Medallion

Price history for Jet Medallion

What does this mean for you?

As older cards are fetching higher premiums, and even the smallest corners of the Magic community are showing increased buying power and higher and higher amounts of control over already limited quantities of cards, It just goes to show that we can't ever be sure that a card won't see significant interest. Shivan Dragon, while being an iconic card, has not seen major price adjustment for even its Fourth Edition printings (at least until the people noticed Fifth Edition prices, but who knows how long that might last), and most would be risking it to suggest that prices for a Fifth Edition card would rise this drastically. Even for the Medallions, it would take an incredible amount of foresight to foresee the changes we have seen.

It's very unlikely that these are the correct prices for these cards, but it may influence a higher price trend in the future. Overall, the takeaway is that while bubbles like this may be very profitable for those who are able to participate in them, they might just lead to higher long-term gains.

At the end of the day...

We can all look back and reflect on the market and see how and why these anomalies occur, it is only through experience and practice that we may truly begin to understand and perhaps predict them. This definitely isn't the last we'll see of a misprint-focused buyout, and it could be a good idea to keep an ear to the ground on that front. I wish all of you a good day, and remember, be careful, be smart, and invest in cardboard.