Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

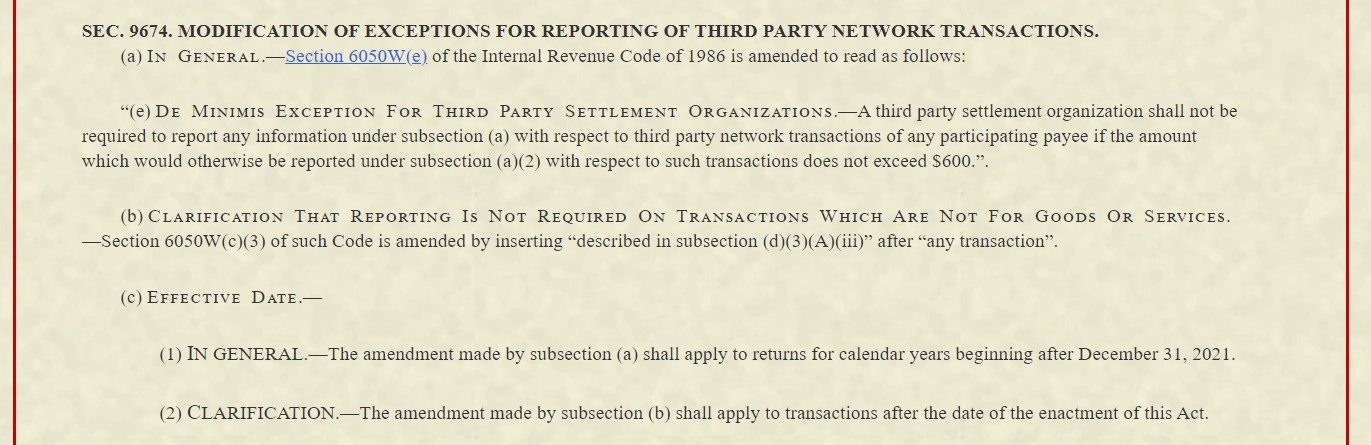

Today's topic is quite honestly only relevant to the QS members who live in the United States, but it's an important one. H.R. 1319 otherwise known as the "American Rescue Plan Act of 2021" had one late addition to it that is extremely relevant to many of us who sell online. Section 9674 amended the minimum value of transactions that required third party organizations to report to the IRS. It used to be $20,000 and now it is $600.

This means that anyone selling online should have been including their profits in any tax returns that they submit to their relevant government. That being said, there are likely plenty of people who don't. (Quiet Speculation strongly encourages its readers to follow all applicable local laws.)

Many small-time sellers have been able to fly under the radar up until now. This provision becomes active starting January 1, 2022, and I imagine it will have large ramifications throughout the online sales realm.

It's important to note that this change affects far more than just collectible card games. I know plenty of non-Magic players who have some small side income from selling things online, and they too will be affected by this law. It is also very important to understand that the taxable income is only on the actual profits one makes, not on one's total sale value.

Let's take a look at the ramifications of this law and how it pertains to Magic finance.

The Good

This change is not bad for everyone. It is actually very good for anyone who regularly sells more than $20,000 online every year. As they are already getting hit with taxes on that income, this change won't cost them any additional money.

What it does do is put a potentially new burden on many of these larger's vendor's smaller competitors. One challenge many of the larger retailers have always had versus the "backpack grinders" is that they have overhead costs that have to be accounted for that just won't apply to the small-time seller. They have employees, building costs, utilities, and taxes – which all have to be priced into their buy and sell prices.

Smaller sellers often don't have all or any of these costs and thus they can typically afford to buy cards for a little more and sell them for a little less. While many smaller sellers still will not have the employees, building costs, or utilities, they now will have taxes that must be accounted for. For higher-volume sellers, this likely means less competition to buy and that they can buy at lower prices than before.

While I would absolutely suggest talking with an accountant before going deep on deductions, it is worth noting that you can deduct your business expenses from your overall profits before taking taxes into account. These deductions may include things like envelopes, stamps, top loaders, penny sleeves, bubble envelopes, and other incidental costs of doing business.

This law is also likely good news for anyone in the personal accounting field, as they are likely to see a significant uptick in business from a whole lot of new small businesses all of a sudden existing.

The Bad

While this change may be good for larger sellers, it is bad for the smaller ones who have not been claiming their side income on their income taxes. They won't be able to fly under the radar anymore, and the $600 maximum is something many can hit within the first month or two of the year.

I imagine we will see a lot fewer store names on TCGplayer in 2022, as many of these sellers may decide to close up shop rather than perform accounting operations. I also suspect that TCGplayer as a whole will likely see a significant drop in revenue next year because of this, as one of its bigger draws is that one can obtain cards at lower prices than many major retail outlets. This also means one can expect the average price of cards to increase as the cheapest sellers stop selling or have to add the tax burden into their prices.

This is also bad news for those who need to cash out of their collections, as those collections will now be worth less money than before, if only due to the reduction in competition for buying and lower buy prices.

The Ugly

For those who continue to operate their online stores and have sales exceeding $60,0 a significant amount of record keeping will likely be required.

While previously many might simply lump transactions together – "purchased collection for $1200", "sold $800 to a buylist", etc. – as taxes are due on the profit derived from each sale, small-time sellers will need to track their individual sales far more diligently. It is also important to note that inventory gains at the end of each year are also subject to taxation; so if you start the year with $14,000 in inventory and end it with $20,000 than you will be taxed on the $6000 increase.

I know many people buying collections off of Facebook already request TCGplayer collection trackers, which provide an itemized list. If you use some method of determining your offer based on this type of list, then you likely have an itemized purchase price; however, for those who don't, you may want to start determining a method to do so.

It is also important to note that those operating these stores may now be considered small businesses, so beware of any local or state laws that specifically pertain to small businesses.

Conclusion

The change to the online selling landscape will be a major one. I have no doubt that this will lead to a not-insignificant boost in tax revenues for the U.S. government and a whole lot of people struggling to understand all the ramifications of "owning a small business." In the end this change is bad for small online sellers and people who buy their cards online and good for the larger online sellers who already had to deal with all of the tax challenges and now will have less competition over buying and selling cards.

I'm the first to admit that this is a complicated subject, and I would love to hear from anyone who works in accounting, tax law, or another related field who may have additional details or a different perspective.