Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

While Summer Solstice isn’t until June 20th, 2021, it sure feels like summer is in full swing. The heat is rearing its ugly head, my allergies are in full force, and in my neck of the woods, the largest brood of Cicadas numbering up to 1.4 million per acre are out and about. I also went on the obligatory “summer family vacation” and we haven’t even hit the middle of the month yet.

In the world of Magic finance, the summer is a time of consolidation—prices drift lower as people find alternate activities out-of-doors for entertainment. This is magnified this year by the re-opening of the world as we (hopefully) look at the pandemic in the rearview mirror and start to look ahead to a semblance of normalcy.

I have already seen some signs of weakness, but it isn’t widespread. This week I’ll highlight some areas of interest, including a two-week look-back at the Modern Horizons 2 article I wrote to start.

Modern Horizons 2

Two weeks ago Modern Horizons 2 preorder prices appeared far too elevated to be realistic. I wrote a strong piece detailing the lofty values of the cards and compared them to the first Modern Horizons (which remains a better investment for now, by the way). Since that article’s publishing, prices on MH2 singles have tanked very hard!

Just check out the bottom portion of MTG Stocks’ Interests Page for the biggest decliners over the past week. I zoomed out on my internet browser and I still can’t get all the MH2 decliners on one screen!

Note that these are drops in market pricing, meaning that cards have been selling at these reduced prices relative to a week ago. It was inevitable to see Inevitable Betrayal and most the other MH2 card prices to tank, but even I could not have predicted an 80% decline in a week!

Dozens of rares, mythic rares, and others have seen their prices slashed by over 50%. Only one Modern Horizons 2 card shows up in the weekly gainers section of the Interests page: Svyelun of Sea and Sky, which climbed a modest 7%. Needless to say, the set’s EV has been tanking as prices equilibrate and find a more balanced level.

A time will come when these will bottom, and much like the first Modern Horizons, there will be a buying opportunity. But there’s no need to rush. Not this early into the set’s release and not at the start of summer. Let these prices come to your levels and not the other way around.

Declines in Other New Cards

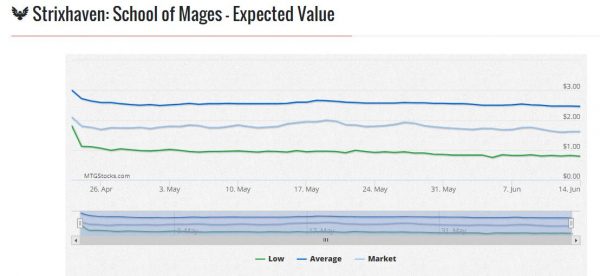

Modern Horizons 2 cards aren’t the only ones exhibiting signs of weakness. While not nearly as drastic, Strixhaven cards are still drifting lower as they seek out their relative bottom.

Over the past two weeks, the market price Expected Value of Strixhaven according to MTG Stocks has dropped from $1.75 to $1.62, a decrease of about 7.5%. While this seems like a small number, consider that a) this was over the course of just two weeks and b) this reflects the entire set. If you ask me, this kind of 2 week move is meaningful.

Ikoria has been out a good bit longer than Strixhaven, so perhaps this is a better set to consider when looking for seasonal effects. After all, Strixhaven is still relatively recent, so we could still be burning off some preorder hype prices even now. With Ikoria, we are sufficiently passed release so trends will be more organic.

You can see that the set’s expected value had bottomed and was on the rise, but I note an inflection point throughout the month of May. The set’s value had been steadily climbing until April. From April through today, however, the expected value of Ikoria has declined a hair: from a peak of $3.38 to about $3.11, an 8% decline. It’s subtle on the chart above, but it is visible.

By no means is this a Chicken Little cry, stating that Magic is ruined and the sky is falling. This is normal for this time of year, and I’m highlighting the trend for awareness and as a way of supporting the notion that things are somewhat normal in the world if Magic finance.

Older Cards

It’s harder to track older cards because their prices move in disjointed steps rather than subtle curves. A card will hold a constant price on MTG Stocks for days and then suddenly move by 30% when a single copy sells at a “new price”. Expected Value calculations also don’t carry much meaning when you’re talking about a set like Arabian Nights or Legends.

Therefore, my data source is going to be more anecdotal in nature as a result. First and foremost, there are Card Kingdom’s buy prices, which have declined off their highs lately. As recently as a couple weeks ago, most of the Revised Dual Lands were showing up on Card Kingdom’s hotlist with reasonable, though not-quite-at-their-peak buy prices. Now all duals are off the hotlist, with many offers significantly off their highs.

The same trend has occurred with cards from the Four Horsemen sets with few exceptions (more on those later). I remember when Card Kingdom offered over $2,200 for a near mint Library of Alexandria. Then the offer dropped to something like $1,980, then $1,800, and now it’s at $1,680. They used to pay over $400 for near mint Erhnam Djinns and now their buy price is $340. For Moat they were paying around $1,140 as recently as a week or two ago and now they offer $940.

The list goes on and on. This isn’t a danger sign or any indication that Magic is suddenly unhealthy. This is a natural price regression after the aggressive buying we had been seeing over the past year. It’s not only healthy, but a positive sign of normalcy in seeing prices soften over the summer, as they usually do. I’m not viewing this weakness as a warning; instead, I see it as an “all clear”.

The normalcy is reflected in a return of supply to the market, another indicator that prices are softening. Card Kingdom has restocked much of the Four Horsemen sets after being out of stock for what felt like months.

I’m also noticing that ABUGames is once again listing cards from Alpha, Beta, and Arabian Nights on eBay, and auctions are ending without bids yet again. This became the norm months ago, but then it seemed like they ran out of cards to sell. Anything they listed received multiple bids the first time around. Now we’re back to the Dutch Auction style they typically implement—they list a bunch of older cards with high starting bids, no one bids, so they re-list again with a slightly lower starting bid. Rinse, repeat.

Staying Positive

Since the COVID-19 pandemic began, there was a great deal of uncertainty around what would happen to various markets. Would there still be demand for Magic cards in a world where there were no in-person events? How would Wizards maintain a cycle of new releases without the hype of prereleases? What would happen to Modern staples with no Modern tournaments taking place?

These doubts were in the back of my mind, especially when it was yet unclear what kind of reach the pandemic would have into our lives. But my concerns quickly shifted from card demand being too soft to card demand being too strong! Prices, especially on the older stuff that I follow most closely, were going through the roof and there was no supply to replenish the market.

I watched closely as Card Kingdom upped their buy prices again and again to new highs; other vendors, such as Star City Games and ABUGames also moved their buy prices up in step. In some cases, Star City Games leapfrogged over Card Kingdom, paying even more aggressively on certain singles. I was left wondering if the madness would ever end!

Well, it appears the madness will indeed end, and that end is happening now. Don’t get me wrong—prices are going to settle much higher than they were two years ago. But they aren’t near the astronomical peaks they once saw. Such explosive growth is unsustainable, and we were destined to overshoot to the upside. Now that we have, it’s natural to see prices retreat back toward a more sensible level.

What helps me feel especially optimistic, despite the fact that my Magic portfolio’s value has been on the decline these last couple months, is seeing the pocket of strength that lingers in the market. On the whole, prices aren’t cratering; I suspect we’ll see some softness for a couple months at least, but at least they aren’t retreating in a threateningly fast manner.

And on an individual basis, some cards are still training near their highs, perhaps reflecting a true shift in demand for the cards. For example, Card Kingdom is still paying $325—near highs—for Rasputin Dreamweaver. Also from Legends, Dakkon Blackblade and Acid Rain continue to trend favorably on buylists.

From Antiquities, Candelabra of Tawnos has held up reasonably well and Argivian Archaeologist is still at (or at least near) its all-time high buy price of $180. The Dark buy prices have weakened somewhat, but isn’t that a good thing? The cards from that set are nowhere near as powerful or rare as those from Arabian Nights and Legends.

I view these pockets of strength as reassuring—a reflection that prices are correcting as needed, but also the market’s acknowledgment that some cards should be trading at higher prices due to their utility, collectability, and rarity.

Wrapping It Up

I took a rare week off last week from writing to enjoy my family’s summer vacation. Despite experiencing the lingering effects of COVID-19, I must say the experience of “getting away” helped life feel more normal than it has any other time these past 15 months.

As I review the current state of Magic’s secondary market, I’m seeing equivalent signs of normal activity. Just like we saw with the Reserved List buyouts from a couple years ago, we’re seeing a gradual, deliberate retrace in prices after things became far too lofty.

When we saw the pullback a couple years ago, it led to a lengthy period of consolidation. Prices stabilized and then didn’t do a whole lot for a while. This was a resting period before the market could heat up again, and prices could climb to the next level. Now we’re seeing history repeat itself, and it gives me confidence that the same trend will again take place: prices will calm down, stabilize and move sideways or slightly lower for the rest of 2021 (and possibly most of 2022) before once again catching a bid.

If that happens, I remain as confident as ever that holding my collection through the coming summer slow-down is a perfectly fine strategy. I may not be using my cards as much as I try to enjoy the warmer weather and the time off with family, but I’m confident interest in Magic will be rekindled once again and prices will react accordingly. History will repeat itself again as it has done multiple times in the past.