Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

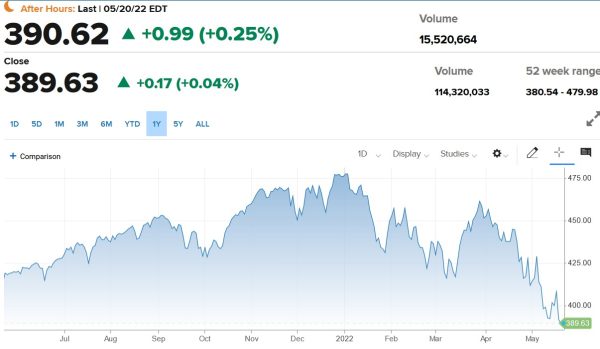

It should not seem too farfetched for me to claim that the global economy is not exactly at its strongest right now. In the U.S. specifically, the S&P 500 briefly touched into bear market territory last Friday (20% drop from highs). Cryptocurrency has also pulled back dramatically, and with rising rates on the horizon it doesn’t even feel like holding bonds would be too wise.

This magnitude of weakness has ripple effects across nontraditional investments as well, including Magic. In fact, I’ve been observing a few signs of market weakness recently. I don’t foresee the Magic economy collapsing or anything nearly so dire. Rather, I’m just anticipating some more weakness to come as prices come in and demand softens. It may even be a decent buying opportunity, if timed correctly.

Until then, I want to highlight some of the signals I’m seeing that indicate the market is still weakening—when these turn around, I will be much more confident that we’re finding a bottom. Keep an eye on these signals as your indicator of market strength.

Signal 1: The Large Bid/Ask Spread

What do I mean by a large bid/ask spread? I define “bid” as the price someone a buyer is willing to pay for a given card. The “ask” is the price a seller is willing to sell that same card. In a healthy, consistent economy, the bid and ask prices are close to each other, enabling the flow of goods and money. When they drift apart, however, something bizarre happens: transactions come to a crawl, and it becomes difficult to determine a fair market value for cards.

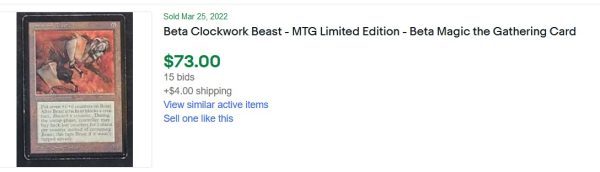

I have a personal example I want to share. Most readers know that I enjoy collecting the occasional low-end Beta rare for its rarity, collectability, and nostalgic appeal. I was looking at Beta Clockwork Beast as a somewhat playable, sub-$100 rare (if in played condition).

The cheapest on TCGplayer right now is a moderately played copy for $133.88 plus shipping. There are a baker’s dozen listings currently, and prices only go up from there. I was watching an eBay auction a couple months ago for a played copy, and decided I’d place a bid. I figured if I could get the card for 20% off TCGlow, I’d be in pretty decent shape, and anything under $100 would be gravy.

Here’s how the auction ended:

I paid $77 plus tax for this decent condition Beta Clockwork Beast! Card Kingdom pays more than that in store credit for HP copies! What happened? Why did this card sell so cheaply? The number of buyers of these cards has decreased recently, so at auction they’re selling for much less than expected. Had the seller listed their copy with a $100 buy-it-now price tag, there’s a great chance it would have just sat there rotting. In fact, there is a copy that’s around that price on eBay right now!

Even this price is about $20 more than what I paid, indicating the bid/ask spread has widened.

Another quick example is Beta Zombie Master. This rare is a little more playable, and demands a higher price as a result. TCGlow has a heavily played copy for $350 plus shipping.

However, there are no recently sold listings on TCGplayer, so exactly what is this card truly worth? Well, the last copy to sell on eBay went for just over $300, so that already indicates a gap between bid and ask. Here’s the kicker, though: I mentioned this card specifically because I have a heavily played copy listed on eBay for sale myself. I’ve dropped the buy it now price all the way down to $242 and still I can’t make the sale. That’s 30% below TCGlow! I had no luck selling the card on the Old School Discord either.

This example goes to show you that just because a card is posted for sale at a given price point doesn’t mean that price point is merited. As the bid and ask spread widens, it becomes even more difficult to sell cards at their previous “market” price.

Signal 2: No One Beats Buylists

I want to dwell on Beta Zombie Master a little longer. Up until last week, Card Kingdom was paying $480 on near mint copies of this card. That means they were offering 40% of that, or $192 for HP copies. Compare that with what I’ll get if I ever end up selling my copy on eBay for $242—after fees it won’t be so far apart. If I am OK with store credit, then trading to Card Kingdom would definitely have been the route to go.

Unfortunately, that buy price didn’t stick, but this was because of my own actions. You see, I had a second Beta Zombie Master that I shipped to CK, and it triggered them to drop their buy price of the card from $480 to $400. The card I shipped was more in the LP range (it hasn’t been graded yet). Shipping that copy to Card Kingdom was a no-brainer because I was fairly confident I wouldn’t have been able to earn more by selling privately or on eBay. The other copy I had posted, which wasn’t selling, was solid proof.

When Card Kingdom is offering more on some cards than the player base, something is definitely not right.

Another recent firsthand example is Beta Mind Twist.

Card Kingdom’s buy price was peaking at around $1740 for near mint copies of the card. I had a moderately played copy I was thinking of selling. Once again, TCGplayer’s listings didn’t provide an accurate reflection of the market. The lowest price posted there is heavily played for $1688.40 plus shipping. I thought I would surely be able to sell my copy for $1400—it was in better condition and $250+ cheaper than the next cheapest listing.

It didn’t sell. Nor did it sell at $1350, $1300, $1200, or $1100. I had to drop my price all the way down to $1050 in order to find an overseas buyer. Had I shipped the copy to Card Kingdom while they were offering $1740 for near mint copies, I would have likely received $1044 (assuming my copy was graded VG). Granted, Card Kingdom dropped their buy price a little, but the fact of the matter is that I couldn’t really sell this card for more than buylist.

Signal 3: Retailers Charge Less than TCGplayer and eBay

While Card Kingdom was paying so well on older cards, they had plenty of opportunity to restock their inventory. Now those cards are sitting on their website and not moving so quickly. This is likely why we’re seeing buy prices drop steadily. This trend extends beyond Beta, where I have been focusing my attention thus far.

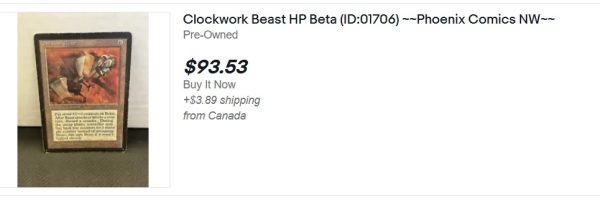

As an example, consider Arabian Nights Erhnam Djinn—I’ve seen Card Kingdom steadily drop their buy price on this card over the past couple weeks. Currently they have three G copies in stock with $314.99 price tags.

The cheapest copy on TCGplayer is $323.99 and in damaged condition. Thus, Card Kingdom is selling copies for less than any seller on TCGplayer. Normally a premier retailer merits a small premium relative to the market, not a small discount. Imagine if you had store credit—you’d be able to nab a copy of this card for well below what it would cost you to acquire it anywhere else. You’d also be paying less than the last three listings that sold on eBay.

Before you rush out and pick up those copies from CK though, be forewarned. Just because you can acquire copies below TCGplayer doesn’t mean you’re getting a steal. Refer back to the above signals: cards are not selling at their posted prices. In the current market environment, you need to beat the TCG low significantly to get a quick sale. This is an indicator of market weakness.

I am confident that other examples like Erhnam Djinn can be found readily by simply browsing Old School cards.

Wrapping It Up

The current market for older Magic cards is fairly weak relative to 2021. There’s no need to panic and cash out of everything. I truly believe we’re just seeing some of the fluff come out of the market, and prices are heading back towards where they belong. And of course, global economic weakness is also reflected in the Old School Magic market as well.

We need to see a few signals reverse themselves before I’m confident in a market bottom. When copies start selling on TCGplayer, and Card Kingdom starts selling through their inventory, and cards are selling privately for more than buylist, I’ll become more optimistic.

Until then, this is definitely a buyers’ market. My advice to folks who are looking to acquire cards right now is to wait for your price. Be patient. Just because a card is listed for sale 10% below TCGlow doesn’t mean it’s a snap buy, especially in this current market environment. When you see a posting for a card that looks like a steal, make sure you check vendor inventory in addition to TCGplayer and eBay listings. Some vendors just may have copies in stock for less than the rest of the web.

When this is no longer the case, we’ll see a rebound. Given inflationary pressures, rising interest rates, and struggling supply chains, this may take a little while. Be prepared to wait.

I did notice something very interesting with a purchase I made recently. I bough an Alpha from an Ebay seller who promised an Ebay Authenticity Guarantee. I had no idea what it was. The tracking made a slight detour to authenticate the card in another city and then arrived sealed in a small packet which can also used for display. None of the cards he was selling were in top shape. Some better than others. He sold all of them at top market price by throwing in an authentication service. I just checked the other day they’re all gone. Looks like buyers are more afraid of getting ripped off than I thought. Card Kingdom is one of the most trustworthy sellers out there. I think that’s the big difference.

This is definitely a “hurry up and wait” moment for the economy and not just Magic. However, this will most likely be a good time to top off inventory.