Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

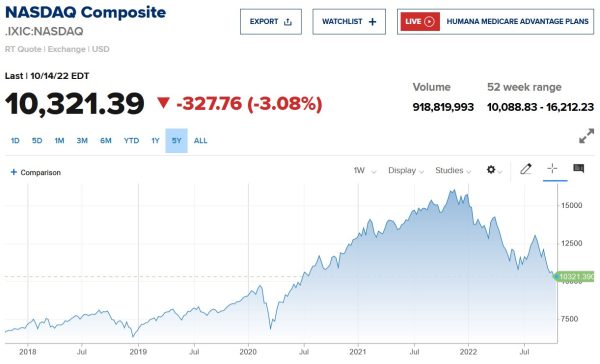

After a few consecutive years of consistent gains in the stock market, it was easy to become complacent. It didn’t matter which popular tech stock you were looking at, it seemed, they all moved up in tandem. The NASDAQ composite soared from around 7200 at the beginning of 2018 to a peak of over 16,000 late last fall. That’s more than 100% in gains!

Then reality set in, and the market started to cool off. This is not uncommon—the stock market tends to overshoot on the upside as well as the downside. From November 2021 to today, the NASDAQ has shed nearly 6,000 points, and many once-loved tech stocks came down drastically, some as much as eighty to ninety percent.

While it has been extremely painful to watch my portfolio give back all its spectacular gains from the last few years, it’s a stern reminder that the good market giveth and the good market taketh away.

Is Magic any Different?

When it comes to the stock market, it’s impossible for me to try and time tops and bottoms precisely. In fact, I’d argue it’s impossible for almost anyone. People who succeed in doing so can thank their intuition as well as Lady Luck. For this reason, I manage my stock portfolio very deliberately, taking profits on the way up in order to lock in some gains before the inevitable pullback.

Unfortunately, this time around I didn’t do such a great job at that. I took some profits, but not nearly enough. I let my complacency (a harsher term could be “greed”) get the best of me.

Shifting gears to Magic, I hypothesize that a similar trend is unfolding as we speak. Prices, particularly on the most collectible cards from the game’s early years, soared throughout 2020 and 2021. 2022 has been a different story. Many prices on once-hot cards have significantly retraced. Even dual lands have not been immune to this trend, though their pullback has been less offensive than others:

If you want to see a more painful price chart, check out the history on Golgothian Sylex. The artifact from Antiquities had a peak buylist price near $50 once upon a time. The best offer today? Roughly half that.

Fortunately, not every Old School card price has softened this drastically. Some Commander staples, such as Gaea's Cradle, have managed to hold onto their premium despite the weakening economy. It’s certainly not all doom and gloom.

I do not expect the secondary market to collapse. On the other hand, I can’t help but wonder if we’re in for a lengthy phase of consolidation and weaker pricing. It’s coincident with the broader economy, which is likely in a recession of sorts. Just like with the stock market, Magic card prices tend to overshoot to the upside and downside. I’d argue the trends mirror each other significantly, and that Magic finance is undergoing a prototypical contraction.

Then Why Sell?

Despite the fact that prices are already off their peak, I’m still making a point of selling more aggressively this time around. Why is that? I already missed the peak, so am I not selling into market weakness rather than strength? What gives?

These are fair questions, and I won’t have a perfectly rational answer to address them all completely. I will do my best to outline the four main reasons I’ve decided it’s a good time for me, personally, to scale back my Old School collection.

Reason #1: Locking in Gains

I watched my paper gains in the stock market evaporate throughout 2022. Not all my positions moved from in the green to in the red, but enough moved enough in the red to cancel out those I own still on the positive side. It’s painful, but I know the stock market will come back eventually and I have time. I can be patient.

In Magic, I’ve seen some of my gains erode but not nearly all of them. What’s more, I don’t have as much time because I want to raise money from Magic to help fund my kids’ college educations. Yes, my eldest is only ten years old, so one could argue that I have seven years yet before I’d have to sell out. There’s a peace of mind factor here that motivates me to take the healthy gains I have today, rather than letting my greed take over and hold out for more.

Reason #2: Magic is Still a Game

When I purchased my first piece of Power back in 2015 (A Mox Jet for $700), I wasn’t ignorant of the fact that these cards could double up as investments of sorts.

I figured it was safe to buy that piece of Power or dual land because they would likely remain stable or appreciate over time while I got to enjoy playing with the cards. It was a true win-win, one that makes Magic a special kind of hobby. I wish my other hobbies, such as running and bowling, led to financial gains over time.

At this point, however, playing with these cards almost feels reckless. Am I really going to shuffle up a Mox Jet for a sanctioned Magic event? Maybe once every couple of years at most, but it feels more and more irresponsible to do so. At these numbers, iconic cards have become investment pieces first and game pieces second, whether I like it or not. I could never have anticipated these cards growing as much as they have in price, but at this point, I’m simply not comfortable holding them. I can enjoy the game just as much playing budget decks or proxies instead.

Reason #3: Waning Interest

My love for Magic has risen and fallen over the past 25 years. When I was brand new to the game the world was my oyster—the thrill of opening a booster pack meant new avenues to explore and deck ideas to pursue. College meant a short hiatus from the game, but adulthood brought me right back in. It has been a wild ride. I completely missed out on Mirrodin block with no regrets.

Now, at 38 years old, as a parent with two children, my priorities have shifted dramatically. As a result, the way I enjoy Magic has also evolved. Instead of heading to a couple of Grands Prix a year and battling in weekly Legacy tournaments locally, now I play goofy games of Commander with my ten-year-old and enjoy a draft now and then on Arena. Magic will always have a place in my life, but I don’t need expensive cards to maximize enjoyment anymore. Since my love for collecting older cards has waned, it may make sense to move on and let someone else enjoy them for a while.

Reason #4: The Big Unknown

I’m not a fearmonger here. No matter what Wizards of the Coast has done over the past 30 years, Magic has largely emerged unscathed and successful. Chronicles and Fallen Empires may have been low points for the game, but since then it’s been cruising to new records year after year.

All that being said, I would be lying if I said I felt great about the Beta reprint set Magic 30. Will the supply be anything significant enough to damage Old School prices? Outside of Collectors’ Edition, I think not. This one-time special set will be a fun flash in the pan and could even rekindle excitement for the originals.

My concern is not that the set exists. It’s the underlying motivation of Hasbro to create such a set. Hasbro plans on expanding profits by 50% in three years, and Magic: the Gathering will be a heavy driver of this growth. For 30 years the makers of Magic have not interacted with nor acknowledged the secondary market. Over that time, the value of the secondary market has ballooned to hundreds of millions of dollars. In my opinion, Magic 30 is an attempt by Hasbro to harness some of the value of the secondary market.

If it goes well, they’ll do it again. As I said earlier, this may have minimal bearing on the original printings. Mana Drain has been reprinted several times, yet the original is still nearly $300.

This alone is not a reason to sell. In conjunction with the other factors above, it does make me feel a little more at ease in my decision to sell. I’ll still maintain a collection, but a much smaller, more modest (and, quite frankly, more fun-oriented) collection. I think I can still enjoy the game without the money component being so central to it.

Wrapping It Up

There you have it. I’ve done my best to outline the reasons why, for me, it’s a good time to sell some cards. To be fair, I’m always buying and selling something—I enjoy the sense of liquidity that Magic offers, and who doesn’t love receiving #MTGMail now and again?

That said, I feel I would be deliberately misleading readers if I said this selling cycle was like all the others for me. It’s not. I’m making a more concerted effort to cut down on my collection. Is it the ideal time to do this? Certainly not—for one, I have no idea where the absolute peak will be (if it’ll ever be achieved) and for another, I could have done better if I had sold six months ago.

That’s all water under the bridge now. Just like with the stock market, every day I end while owning a stock and a Magic card is effectively a day I bought said asset. The opportunity cost alone makes this true. I sit here ruing the fact I did not sell more stocks—especially the growth stocks—during last year’s peak.

I refuse to let that be me in Magic. At this stage in my life, I’m much more inclined to regret selling too late than regret selling too soon. Perhaps that, in the end, is the ultimate reason it’s time for me to scale back.

I follow the price trends of gold as a more accurate reflection of the price trends of collectibles like Magic. Gold is down 15% this year., which is very similar to how Magic and other collectibles are faring right now. Given the market it’s still a very safe position for both. 20% to 25% uspside in gold sounds almost like a sure thing.