Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

The Modern RCQ season is nearing its end, so Modern's metagame will shift into waiting mode. At least we'll get another one next year. Everyone assumes that at least one card will be banned on December 16th, and, given the data this month, we know which deck will be targeted. Which card(s) will be targeted, however, is anyone's guess.

The Obvious Outlier

As I and I assume everyone else expected, Boros Energy is a massive outlier in October's data across Magic Online and paper. The outlier tests were just due diligence to see if anything else would be joining it. Everything else on MTGO were solidly safe, though both Amulet Titan and the Domain Zoo piles were borderline. The most restrictive test had them as outliers, but none of the other ones did, so they stayed in the data set. As always, outliers are removed from the statistical analysis but are reported on their correct place on the Tier List.

Despite its metagame percentage, Boros Energy is not a Tier 0 deck. It has the massive metagame percentage down on MTGO, but its average points are too low in both play-mediums. In fact, if I was only looking at RCQ results, Boros Energy would have severely underperformed on average points at 1.44.

For comparison, if I do that to Titan it'd fall to 1.67 but remain above Baseline while decks like Tameshi Belcher are unaffected. Boros did very well in three early 3-point events, but performed poorly in the medium range, 2-point events. As the majority of paper events are small 1-pointers, it's critical for decks to show up to those medium events to keep their totals up, especially a deck as popular as Boros.

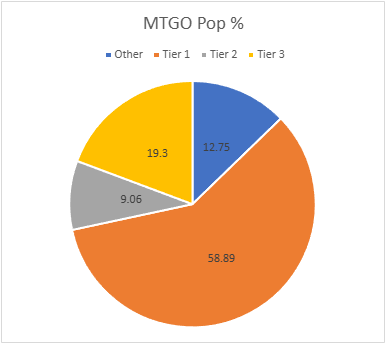

October Population Metagame

To make the tier list, a given deck has to beat the overall average population for the month. The average is my estimate for how many results a given deck "should" produce in a given month. To be considered a tiered deck, it must perform better than "good enough". Every deck that posts at least the average number of results is "good enough" and makes the tier list.

Then we go one standard deviation (STdev) above average to set the limit of Tier 3 and the cutoff for Tier 2. This mathematically defines Tier 3 as those decks clustered near the average. Tier 2 goes from the cutoff to the next standard deviation. These are decks that perform well above average. Tier 1 consists of those decks at least two standard deviations above the mean result, encompassing the truly exceptional performing decks.

The MTGO data nearly exclusively comes from official Preliminary and Challenge results. Leagues are excluded, as they add analytically useless bulk data to both the population and power tiers. The paper data comes from any source I can find, with all reported events being counted.

While the MTGO events report predictable numbers, paper events can report anything from only the winner to all the results. In the latter case, if match results aren't included, I'll take as much of the Top 32 as possible. If match results are reported, I'll take winning record up to Top 32, and then any additional decks tied with 32nd place, as tiebreakers are a magic most foul and black.

The MTGO Population Data

October's adjusted average population for MTGO is 10.04. I always round down if the decimal is less than .20. Tier 3, therefore, begins with decks posting 10 results. The adjusted STdev was 16.97, so add 17 and that means Tier 3 runs to 27 results. Again, it's the starting point to the cutoff, then the next whole number for the next Tier. Therefore Tier 2 starts with 28 results and runs to 45. Subsequently, to make Tier 1, 46 decks are required.

The sample population fell, and while I know the mechanics I don't know the reason. Challenge size was down, with some barely making 32 players, which meant I only took those decks with winning records. I'm told that the prize support's been decreased, which makes Challenges less appealing. October's population is 1192, down from1360 in September. The number of unique decks fell to 88, so the unique deck ratio is 0.074, functionally the same as in September. The number of tiered decks rose from 23 to 27. The data's horribly warped, but at least diversity is holding steady.

While Boros continues to blow every other deck away, I remain unimpressed. It surged to the top spot on the basis of the first two weeks of data. After that, it fell off and Mardu Energy began making a comeback. I was never clear why Mardu fell off in the first place, but MTGO's playerbase is notoriously arbitrary and capricious, turning on successful decks for no apparent reason.

The resurgence is likely due to October's Big Story: combo has arrived! Boros Energy is not a very fast aggro deck, primarily dealing chip damage before a big turn involving Ajani, Nacatl Avenger and/or Goblin Bombardment. It was vulnerable to racing if you could dodge its removal and blockers, which is where pure combo decks come in. Ruby Storm has put up solid numbers as a result, but the real winner has been Goblin Charbelcher.

Wizards' love of MDFC's like Sink Into Stupor have allowed the deck to go mono-blue. In turn, they're now running as many free counterspells as possible, meaning they can defend the combo while answering hate. The version using Lotus Bloom and Tameshi, Reality Architect is by far the most successful version, as drawing lots of cards and making lots of mana is always good in combo decks. We'll see if it can sustain this success. Mardu has a much better matchup against combo than Boros, which is likely driving its resurgence.

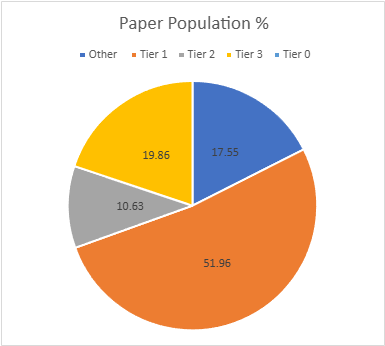

The Paper Population Data

The RCQ season is winding down, and events were generally smaller than in September. That said, paper's population is still high for the year. January had 803 decks, February 890, March had 311, April hit 559, May fell to 389, June had 536, July rose to 589, August hit 758, September surged to 1155, and October is down to 997. Diversity has recovered slightly, with 97 unique decks and a ratio of 0.97. up from September's .093.

The population decrease is countered by the diversity increase, and 27 decks made the tier list. The adjusted average population was 8.60, so 9 results make the list. The adjusted STDev was 13.09, so the increment is 13. Therefore, Tier 3 runs from 9 to 22, Tier 2 is 23 to 36, and Tier 1 is 37 and over.

As I've alluded to, Boros wasn't the force in paper that it was online. It's still a massive outlier, just not as massive. We also didn't see the massive adoption of Belcher in paper as online. Part of this is simply that it's easier to switch decks on MTGO than in paper. However, Amulet Titan never dies because that's all its players want to do. I believe that Titan is taking up most of the available combo space and the other decks aren't able to compete, especially since Titan's going even harder on comboing with Lotus Field and Aftermath Analyst.

Eye, Aye?

The other big story is Abhorrent Oculus. Alongside Unearth, the eye was hailed as a deck redefining card. I'd dispute that conclusion, as the number of cards that have been changed to accommodate Oculus pushes it to being a totally new deck. It also plays more forwardly than Frogtide did. However, it appears that it doesn't matter if you play Oculus or not in paper. Abhorrent Frogtide did exactly as well as the older, eyeless version.

In my experience, Eye isn't an across-the-board improvement. Rather, it moves the deck from tempo/midrange towards tempo/combo. Essentially, it's hoping to get lucky reanimating Oculus on turn 2 and ride it to victory before the opponent can react. Psychic Frog plays similarly but is more vulnerable to removal. This comes at the price of having to play Thought Scour and Unearth, cards that aren't particularly useful outside of Oculus interactions. Normal Frog just plays interaction in those slots. Thus, the decks have different matchup spreads and one version isn't unequivocally better than the other.

Why then, did Abhorrent outperform normal Frogtide online? Again, I'd answer that it's just MTGO being MTGO. They'll jump on new tech instantly because it's new tech, regardless of the tech being good or not. Since a lot of players rent, they can switch easily. Paper players need more evidence to make the jump because they have to buy cards. As a result, online piled onto Oculus and performed overall worse than normal Frogtide did in September.

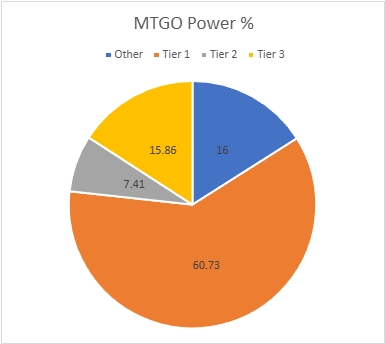

September Power Metagame

Tracking the metagame in terms of population is standard practice. But how do results actually factor in? Better decks should also have better results. In an effort to measure this, I use a power ranking system in addition to the prevalence list. By doing so, I measure the relative strengths of each deck within the metagame so that a deck that just squeaks into Top 32 isn't valued the same as one that Top 8's. This better reflects metagame potential.

For the MTGO data, points are awarded based on the population of the event. Preliminaries award points based on record (1 for 3 wins, 2 for 4 wins, 3 for 5), and Challenges are scored 3 points for the Top 8, 2 for Top 16, and 1 for Top 32. If I can find them, non-Wizards events will be awarded points the same as Challenges or Preliminaries depending on what the event in question reports/behaves like. Super Qualifiers and similar higher-level events get an extra point and so do other events if they’re over 200 players, with a fifth point for going over 400 players.

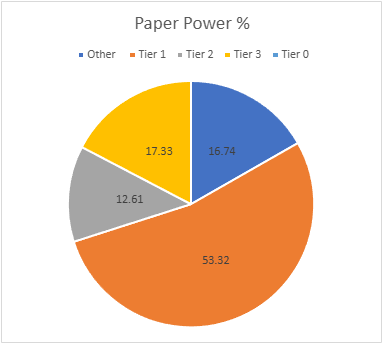

Due to paper reporting being inconsistent and frequently full of data gaps compared to MTGO, its points work differently. I award points based on the size of the tournament rather than placement. For events with no reported starting population or up to 32 players, one point is awarded to every deck. Events with 33 players up to 128 players get two points. From 129 players up to 512 players get three. Above 512 is four points, and five points is reserved for Modern Pro Tours. When paper reports more than the Top 8, which is rare, I take all the decks with a winning record or tied for Top 32, whichever is pertinent.

The MTGO Power Tiers

As with the population numbers, total points are down from 2456 to 2106. The adjusted average points were 17.29, therefore 18 points made Tier 3. The STDev was 30.92, so add 31 to the starting point, and Tier 3 runs to 49 points. Tier 2 starts with 50 points and runs to 81. Tier 1 requires at least 82 points. The bottom end of Tier 3 saw a lot of decks fall off and a few take their place, yielding a net decrease of 4 decks.

The Paper Power Tiers

Paper's total points are down from 1863 to 1673. The adjusted average points were 14.40, setting the cutoff at 15 points. The STDev was 22.89, thus add 23 to the starting point and Tier 3 runs to 38 points. Tier 2 starts with 39 points and runs to 62. Tier 1 requires at least 63 points. Like the online data, a number of decks on the bottom end fell off and some were replaced, meaning paper's down one deck on net.

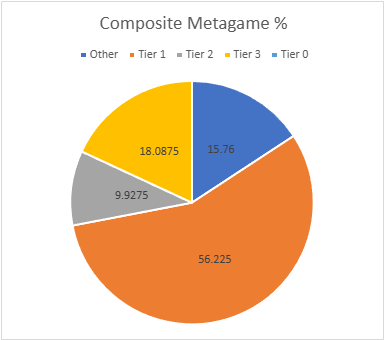

Composite Metagame

That's a lot of data, but what does it all mean? When Modern Nexus was first started, we had a statistical method to combine the MTGO and paper data, but the math of that system doesn't work without big paper events. I tried. Instead, I'm using an averaging system to combine the data. I take the MTGO results and average the tier, then separately average the paper results, then average the paper and MTGO results together for final tier placement.

This generates a lot of partial Tiers. That's not a bug, but a feature. The nuance separates the solidly Tiered decks from the more flexible ones and shows the true relative power differences between the decks. Every deck in the paper and MTGO results is on the table, and when they don't appear in a given category, they're marked N/A. This is treated as a 4 for averaging purposes.

Average Power Rankings

Finally, we come to the average power rankings. These are found by taking the total points earned and dividing them by total decks, to measure points per deck. I use this to measure strength vs. popularity. Measuring deck strength is hard. There is no Wins-Above-Replacement metric for Magic, and I'm not certain that one could be credibly devised. The game is too complex, and even then, power is very contextual.

Using the power rankings helps to show how justified a deck’s popularity is. However, more popular decks will still necessarily earn a lot of points. Therefore, the top tier doesn't move much between population and power and obscures whether its decks really earned their position.

This is where the averaging comes in. Decks that earn a lot of points because they get a lot of results will do worse than decks that win more events, indicating which deck actually performs better.

A higher average indicates lots of high finishes, whereas low averages result from mediocre performances and a high population. Lower-tier decks typically do very well here, likely due to their pilots being enthusiasts. Bear this in mind and be careful about reading too much into these results. However, as a general rule, decks that place above the baseline average are over-performing, and vice versa.

How far above or below that average a deck sits justifies its position on the power tiers. Decks well above baseline are undervalued, while decks well below baseline are very popular, but aren't necessarily good.

The Real Story

When considering the average points, the key is looking at how far off a deck is from the Baseline stat (the overall average of points/population). The closer a deck’s performance to the Baseline, the more likely it is to be performing close to its "true" potential.

A deck that is exactly average would therefore perform exactly as well as expected. The greater the deviation from the average, the more a deck under or over-performs. On the low end, a deck’s placing was mainly due to population rather than power, which suggests it’s overrated. A high-scoring deck is the opposite of this.

I'll begin with the averages for MTGO:

Tameshi wins MTGO Deck of September by good margin.

Now the paper averages:

Another month, another Deck of the Month (Paper) trophy for Amulet Titan. The couple of maindeck Blood Moon effects aren't working, people. Step it up.

Analysis

The RCQ season's data stands at odds with MTGO's conclusion about Boros Energy. As previously mentioned, Boros was saved from underperforming by the points from three big events in early October. Its subsequent point gathering was limited to small events. Meanwhile, it's been performing well online, though even that has been changing. At the start of the month, Top 8's were 50%+ Boros Energy. Increasingly, there are 1 or 2. Energy as whole continues to define the online metagame, but increasingly it's split between Boros, Mardu, and Jeskai variants.

The simplest explanation is that the online community has mysteriously changed its mind about Boros. However, I think that this is actually evidence of metagame adaptation. Jeskai Energy is only playing blue for Expressive Iteration and sideboard cards, primarily Consign to Memory to answer the combo decks. Boros remains the most popular by far, but it's losing ground and is less well positioned than before.

Metagame Health

Metagame adaptation is good, and generally a sign of metagame health. However, it's occurring in the context of Energy being the most popular deck by an incredible margin. Boros alone has an average share of 21.91%, while Nadu only managed 17.81%. The last time Modern was this overrun by one deck was back in Eldrazi Winter. That isn't great.

The problem is that it's not clear if Boros and by extension all energy decks earned their place through actually being the best or taking advantage of metagame complacency and player laziness. Wizards printed that deck into existence. As we said back in the old days, if Wizards is going to make decks for us, we might as well play them. Why dig through the card pile when you can just play the good preconstructed deck? We're moving past that phase, and the flaws are being exploited.

It is possible that natural metagame forces will eventually drive Energy down to reasonable numbers. It's equally possible that the core is simply too good. I don't think the players want to find out. There's a lot of frustration with this metagame. Challenge numbers are noticeably down. Paper is all over the board, and since it generally falls in September before rising rapidly in December, there may be nothing to see there. However, the complaining on all forums is very real. I think this will force Wizards to take action in December.

Financial Implications

Therefore, the big investment question is what cards will be banned.

Everyone assumes that The One Ring is gone. It's in 50%+ of Modern decks, and Wizards already said they're watching it carefully. Players are also generally bored of opponents chaining Rings to stall out the game and win. Ironically, it'd be much fairer if it weren't legendary as burden counters would be more dangerous.

I think Wizards has to pull the trigger. If you haven't sold out of excess Rings, do so quickly. The price will fall, though Legacy and Commander play should keep the floor respectable.

As for Energy specifically, my experience says that the aggro core isn't the problem. Guide, Raptor, and Ocelot Pride aren't that hard to answer with removal and/or bigger creatures.

The problem is the reach from Bombardment, Ajani, and Phlage, Titan of Fire's Fury makes it impossible to stabilize. Phlage is the fairest one and the easiest to answer in my experience, so I'd ban Bombardment and/or Ajani. However, we have a month to see what Wizards does.

In any case, I'd move out of Energy cards in favor of Frogtide and Belcher staples.