Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

It finally happened. The December 16th Ban Announcement did what it was supposed to do, and Modern is in a new place:

- The One Ring is banned.

- Amped Raptor is banned.

- Jegantha, the Wellspring is banned.

- Mox Opal is unbanned.

- Green Sun's Zenith is unbanned.

- Faithless Looting is unbanned.

- Splinter Twin is unbanned.

Sorry to all who wanted Energy gone, but Wizards was never going to do that with Aetherdrift on the horizon. It's quite poor business to kill a deck that stands to benefit from incoming new product.

As a consequence, the December data is severely lacking. It's more of a preview of the new metagame than the definitive look. The January 2025 update will be the first chance to really see what sort of format Modern has become.

Lacking Data and Outliers

This data part metagame update is going to be a lot shorter than normal. It only samples the end of December, otherwise known as the Holiday Season, also known as a completely dead period for paper Magic. There weren't enough events to get a statistically valid sample, so it's going to be Magic Online (MTGO) only. No paper data, no composite metagame. There's no point. For the record, Izzet Twin was on top of the paper chart with 5 results.

On the subject of MTGO, its data has three outliers. I was hoping that would not be the case, but MTGO has to MTGO, which I'll discuss more in the Analysis section. Mardu Energy leads the way, with Abhorrent Frogtide and Boros Energy following.

As always, outliers are removed from the statistical analysis but are reported in their correct place on the Metagame Tiers.

November Population Metagame

To make the tier list, a given deck has to beat the overall average population for the month. The average is my estimate for how many results a given deck "should" produce in a given month. To be considered a tiered deck, it must perform better than "good enough". Every deck that posts at least the average number of results is "good enough" and makes the tier list.

Then we go one standard deviation (STdev) above average to set the limit of Tier 3 and the cutoff for Tier 2. This mathematically defines Tier 3 as those decks clustered near the average. Tier 2 goes from the cutoff to the next standard deviation. These are decks that perform well above average. Tier 1 consists of those decks at least two standard deviations above the mean result, encompassing the truly exceptional performing decks.

The MTGO data nearly exclusively comes from official Preliminary and Challenge results. Leagues are excluded, as they add analytically useless bulk data to both the population and power tiers. The paper data comes from any source I can find, with all reported events being counted.

While the MTGO events report predictable numbers, paper events can report anything from only the winner to all the results. In the latter case, if match results aren't included, I'll take as much of the Top 32 as possible. If match results are reported, I'll take winning record up to Top 32, and then any additional decks tied with 32nd place, as tiebreakers are a magic most foul and black.

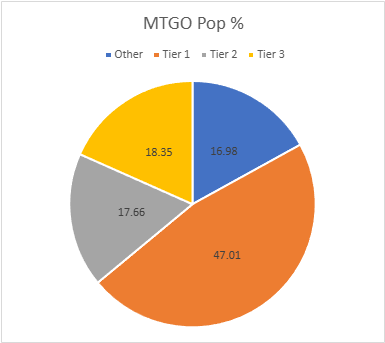

The MTGO Population Data

October's adjusted average population for MTGO is 5.65. I always round down if the decimal is less than .20. Tier 3, therefore, begins with decks posting 6 results. The adjusted STdev was 8.19, so add 8 and that means Tier 3 runs to 14 results. Again, it's the starting point to the cutoff, then the next whole number for the next Tier. Therefore Tier 2 starts with 15 results and runs to 23. Subsequently, to make Tier 1, 24 decks are required.

Obviously, the shorter month translates into a lower population, with only 736 total. However, with that lower total came the return of larger Challenges. Prior to December 16th, the average Challenge barely had enough players to fire. Post-December 16th, they're average 100 players. It's pretty clear that if nothing else, enthusiasm has returned to Modern.

The number of unique decks rose insignificantly to 92, causing the unique deck ratio to fall to 0.125, which is far better than any other month I've measured for MTGO. Of course, it being a short month after a major shakeup is the primary reason it happened. The number of tiered decks rose to 28.

Despite everything, three of the top decks from the previous metagame lead the standings. This does not surprise me in the slightest. Wizards didn't kill Energy, and player want Psychic Frog to be good. Again, I'll discuss this more in the Analysis section.

Meanwhile, Temur Breach Combo soared thanks entirely to Mox Opal being freed. It turns out more free mana makes combos easier. Shocker. Opal appears to be the early winner of the unbanning sweepstakes, but as with everything else, I'd put an asterisk on that assumption. Appearances are very deceiving at the moment. If this trend continues in January, then we'll talk.

November Power Metagame

Tracking the metagame in terms of population is standard practice. But how do results actually factor in? Better decks should also have better results. In an effort to measure this, I use a power ranking system in addition to the prevalence list. By doing so, I measure the relative strengths of each deck within the metagame so that a deck that just squeaks into Top 32 isn't valued the same as one that Top 8's. This better reflects metagame potential.

For the MTGO data, points are awarded based on the population of the event. Preliminaries award points based on record (1 for 3 wins, 2 for 4 wins, 3 for 5), and Challenges are scored 3 points for the Top 8, 2 for Top 16, and 1 for Top 32. If I can find them, non-Wizards events will be awarded points the same as Challenges or Preliminaries depending on what the event in question reports/behaves like. Super Qualifiers and similar higher-level events get an extra point and so do other events if they’re over 200 players, with a fifth point for going over 400 players.

Due to paper reporting being inconsistent and frequently full of data gaps compared to MTGO, its points work differently. I award points based on the size of the tournament rather than placement. For events with no reported starting population or up to 32 players, one point is awarded to every deck. Events with 33 players up to 128 players get two points. From 129 players up to 512 players get three. Above 512 is four points, and five points is reserved for Modern Pro Tours. When paper reports more than the Top 8, which is rare, I take all the decks with a winning record or tied for Top 32, whichever is pertinent.

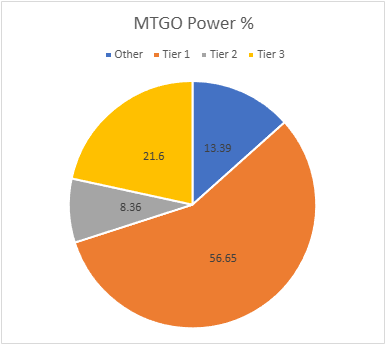

The MTGO Power Tiers

As with the population numbers, total points are down to 1352. We had several 4 and a 5 point event that boosted the numbers. The adjusted average points were 10.17, therefore 10 points made Tier 3. The STDev was 15.72, so add 16 to the starting point, and Tier 3 runs to 26 points. Tier 2 starts with 27 points and runs to 43. Tier 1 requires at least 44 points. Mill fell off and was replaced by Rock Saga and Oculus Frog.

The old standbys of Yawgmoth and Amulet Titan are showing why they're so persistent in every metagame. Green Sun's Zenith slots effortlessly into both decks, and while it doesn't find either namesake card, that doesn't matter when it's finding missing combo pieces. Yawgmoth in particular has retooled to use GSZ for an extra grindy plan for when Yawgmoth doesn't stick.

Average Power Rankings

Finally, we come to the average power rankings. These are found by taking the total points earned and dividing them by total decks, to measure points per deck. I use this to measure strength vs. popularity. Measuring deck strength is hard. There is no Wins-Above-Replacement metric for Magic, and I'm not certain that one could be credibly devised. The game is too complex, and even then, power is very contextual.

Using the power rankings helps to show how justified a deck’s popularity is. However, more popular decks will still necessarily earn a lot of points. Therefore, the top tier doesn't move much between population and power and obscures whether its decks really earned their position.

This is where the averaging comes in. Decks that earn a lot of points because they get a lot of results will do worse than decks that win more events, indicating which deck actually performs better.

A higher average indicates lots of high finishes, whereas low averages result from mediocre performances and a high population. Lower-tier decks typically do very well here, likely due to their pilots being enthusiasts. Bear this in mind and be careful about reading too much into these results. However, as a general rule, decks that place above the baseline average are over-performing, and vice versa.

How far above or below that average a deck sits justifies its position on the power tiers. Decks well above baseline are undervalued, while decks well below baseline are very popular, but aren't necessarily good.

The Real Story

When considering the average points, the key is looking at how far off a deck is from the Baseline stat (the overall average of points/population). The closer a deck’s performance to the Baseline, the more likely it is to be performing close to its "true" potential.

A deck that is exactly average would therefore perform exactly as well as expected. The greater the deviation from the average, the more a deck under or over-performs. On the low end, a deck’s placing was mainly due to population rather than power, which suggests it’s overrated. A high-scoring deck is the opposite of this.

I'll begin with the averages for MTGO:

Having discussed Yawgmoth above, I must now award it MTGO Deck of December down here. Well done. I'd also like to highlight the numbers for both types of Energy. Mardu's performed decidedly mediocrely, especially compared to Boros. However, Boros is only doing that thanks to overperformance in the Super Qualifiers. Take those out and it's in the middle of the pack.

Analysis

There is a lot to unpack. Modern is finally free of The One Ring. Wizards has also taken Energy down slightly by banning Amped Raptor and Jegantha, the Wellspring. However, in a very surprising move, Mox Opal, GSZ, Faithless Looting, and Splinter Twin have all been unbanned. I'll start with the bans before discussing the unbans.

Lowering Energy

There's nothing to say about Ring being gone beyond "Good Riddance!" Wizards should have killed it alongside Nadu and Grief.

Banning Raptor is unexpected. I thought they'd go harder, taking Ajani, Nacatl Pariah to reduce Energy's reach. I'd have hit Goblin Bombardment too. Instead, they went for the card advantage spell. Cascade in any form is proving to cause problems, and since Violent Outburst got axed in March, Wizards had that mechanic on the brain. So, they killed the energy cascade card. Maybe they'll finally learn that it's not an acceptable mechanic. *Wizards won't learn that cascade is not an acceptable mechanic.*

Banning Jegantha is a bit odd. I agree with Wizards' stated reasoning, but I feel that they're obfuscating. With Jegantha banned in Pioneer too, only the most niche companions remain legal in all formats. Consequently, it feels like Wizards is simply acknowledging that Companion is inherently busted rather than Jegantha actually being a problem. Additionally, they knew that only banning one card from Energy wouldn't be enough, and Jegantha fits their actual goal.

As stated above, Wizards was never going to kill Energy before Aetherdrift. Instead, they weakened it enough for players to return to Modern, but not enough to stop playing Energy. Removing all the card advantage spells makes Energy more vulnerable to grind out while keeping its combo/aggro core intact. Ring, Raptor, and Jegantha were all easy ways to outgrind opponents, so now Energy has to actually work for extra cards. It's not weak enough to stop being a top deck, but it should be weak enough not to dominate.

Invoking Nostalgia

The four unbans are utterly shocking. Unbans have been incredibly rare, and there haven't been this many in a tournament format since Legacy was created. Wizards claims they want to try more unbans to drive interest, but I suspect that's another obfuscation. They know that the past 6 months have been miserable and drove many players away. The best way to bring them back is nostalgia. Also, it'd serve as an apology for not killing Energy as many players wanted.

That Opal and GSZ immediately found homes isn't surprising. Opal just replaces the worst card in any artifact deck and GSZ filled The Ring's slot. Simple as. Looting and Twin are having a tougher time. This is likely to continue for Twin as Psychic Frog heavily crowds its old territory. It's a bit more convoluted, but both decks are fair midrangish decks with combo or comboish wins. I think the appeal and upside of Frog is simply too great for Twin to overcome, but I have seen decks playing Twin for value rather than a kill.

I'm concerned about Faithless Looting returning. Wizards claims that more one-shot graveyard hate will keep it in check, but I was there for both 2019 Izzet Phoenix and Hogaak Summer. All the hate and more weren't enough to contain those decks back then, and now Persist is a card. My fears haven't yet been realized, but that's on MTGO, not Looting's potential. It wouldn't surprise me if Opal and/or Looting end up being rebanned.

Metagame Impact

This metagame update's data suggests that the impact of the bans and unbans have been minimal. I'm going to tell you now that the data doesn't necessarily mean anything. I only have MTGO data to work with. MTGO has a tiny playerbase with a heavily inbred metagame. Unless the paper metagame shakes out the exact same way, we can always handwave away MTGO results as MTGO being MTGO.

As mentioned above, I was expecting Frogtide and the two Energy decks to be atop the Tier List. I was hoping they wouldn't also be outliers, but MTGO happened. These were decks that players were playing before the bans. Their core gameplans remained intact afterwards while many of their rival decks were impacted through loss of The Ring. The incentive structure of MTGO doesn't reward experimentation, limiting new deck discovery. Since the old decks still worked, there was little reason for players to switch.

I recorded about 2/3's of all the 92 individual decks on my data sheet from December 17 to 19th. During those three days, players were all over the place. Mardu Energy was at the top of the charts, but Jund Creativity and Hollow One were putting up solid numbers and good results. Then that stopped. Just like it stops every time Modern gets shaken up. If decks don't immediately overperform, MTGO's small number of very dedicated grinders immediately discard them. There's no time or incentive to iron out kinks or test new things. It's very much about instant gratification.

As a result, you need to take the data and its conclusions with a chunk of salt. These results might be indicative of what we can expect moving forward. However, you can't trust MTGO by itself.

Financial Impact

There are Modern Regional Championships coming up. Consequently, I expect demand for Modern staples to rise. The prices of the unbanned cards are still in their speculation phase. I anticipate Opal remaining high, but GSZ and Twin should see some price decline unless there's a breakout deck.

My advice is therefore to plan on buying and holding rather than seek quick turnarounds.