Are you a Quiet Speculation member?

If not, now is a perfect time to join up! Our powerful tools, breaking-news analysis, and exclusive Discord channel will make sure you stay up to date and ahead of the curve.

As anticipated, Wizards banned Underworld Breach on Monday.

Farewell Breach, you're only partially to blame.

Now we wait for Mox Opal to break another deck. Hopefully nothing too soon, as Wizards stated in the follow-up stream that Modern wouldn't be included in the June 30th announcement. For all our sakes, let's hope that the new Ugin isn't as busted as he appears.

In the meantime, it's time for the post-mortem on the Breach Metagame.

The Lone Outlier

There were a lot of large events in March. Magic Online had several Showcases while paper saw the second round of Modern Regional Qualifiers in addition to other big events and championships. As a result, the data looks weird, which probably explains why there's only one outlier across both play mediums.

That outlier was Boros Energy on MTGO, and the tests were unequivocal. It looked like it would be joined by BW Blink, but the tests didn't conclusively agree. The most restrictive outlier tests said it was, the most permissive said it wasn't, and the middle ones were split. Thus, I left it in the analysis. I thought there'd be multiple outliers in paper, but only the most restrictive outlier test produced any. All the other ones said that, despite appearances, everything was within variance.

As always, outliers are reported in their correct position on the Tier List but are removed from the statistical analysis. I'll also mention here that I'm not waiting for the weekend paper results to come in. It usually takes a week for all of them to get posted, and I can't think of a reason to include late results from a dead metagame.

March Population Metagame

To make the tier list, a given deck has to beat the overall average population for the month. The average is my estimate for how many results a given deck "should" produce in a given month. To be considered a tiered deck, it must perform better than "good enough". Every deck that posts at least the average number of results is "good enough" and makes the tier list.

Then we go one standard deviation (STdev) above average to set the limit of Tier 3 and the cutoff for Tier 2. This mathematically defines Tier 3 as those decks clustered near the average. Tier 2 goes from the cutoff to the next standard deviation. These are decks that perform well above average. Tier 1 consists of those decks at least two standard deviations above the mean result, encompassing the truly exceptional performing decks.

The MTGO data nearly exclusively comes from official Preliminary and Challenge results. Leagues are excluded, as they add analytically useless bulk data to both the population and power tiers. The paper data comes from any source I can find, with all reported events being counted.

While the MTGO events report predictable numbers, paper events can report anything from only the winner to all the results. In the latter case, if match results aren't included, I'll take as much of the Top 32 as possible. If match results are reported, I'll take winning record up to Top 32, and then any additional decks tied with 32nd place, as tiebreakers are a magic most foul and black.

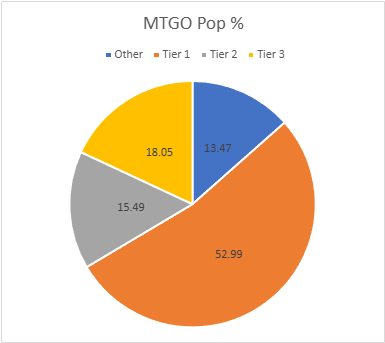

The MTGO Population Data

March's adjusted average population for MTGO is 13.72. I always round down if the decimal is less than .20. Tier 3, therefore, begins with decks posting 14 results. The adjusted STdev was 26.08, so add 26 and that means Tier 3 runs to 40 results. Again, it's the starting point to the cutoff, then the next whole number for the next Tier. Therefore Tier 2 starts with 41 results and runs to 67.

Subsequently, to make Tier 1, 68 decks are required.

The sample population fell again slightly, from 1472 decks in February to 1440, well down from January's 1660. A number of Challenges didn't fire, probably because players knew the metagame was a lame duck. It's disappointing, but that's what happens with scheduled announcements and clearly broken decks.

I have 91 unique decks in my sample, which equates to a unique deck ratio of .063, which is meaninglessly down from February's .065.

24 decks made the tier list.

Boros Energy continues to sit on top of MTGO by a lot despite Breach being the best deck. I genuinely think that's all because it doesn't lose to the chess clock.

The Thassa's Oracle and Grapeshot versions of Temur Breach ended up tied, but this was a very late development. During the first half of March, it was all Oracle Breach, all the time. Then for no apparent reason, it switched in both MTGO and paper to Storm Breach. I would guess that players, particularly the online ones, were tired of having to combo all the way and switched to Storm as a shortcut. All those clicks added up when you're against the chess clock.

This is also my explanation for why Breach isn't on top of Tier 1 in either medium. Breach is not fun to play against and I'm told that it's not especially fun to play either. It can't really be shortcutted, so you've got to play out the repetitive loops. Once the RCs were done, players dropped the deck. Some were selling out since it would obviously be banned, but many just didn't want to play Breach anymore. There are limits to their willingness to just play the best deck.

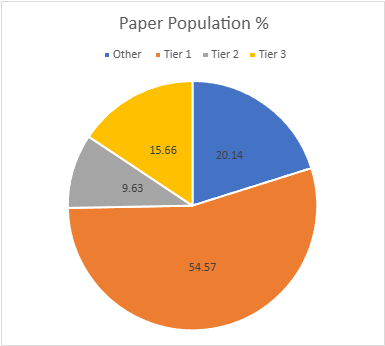

The Paper Population Data

Paper's population rose dramatically from 737 decks to 1028. All the RCs and their side events plus unrelated events sent the sample size through the roof. I recorded 92 unique decks made the list for a ratio of .089. While much better than any ratio from MTGO, that's extremely low for paper. I think this is also the first time I had more unique decks in paper than on MTGO. The relative lack of diversity online has always been a mark against it, but never like this. I'm not sure what to make of it.

17 decks made the tier list, which is also very low for paper. However, that's mostly because there are no outliers, so the unadjusted stats are much higher than normal. The unadjusted average population is 11.17, so 11 results make the list. The unadjusted STDev was 23.93, so the increment is 24. Therefore, Tier 3 runs from 12 to 36, Tier 2 is 37 to 61, and Tier 1 is 62 and over.

Blink and Energy are also the most popular decks in paper, but the order is reversed. Again, I think the chess clock is a factor. Blink is not a fast deck, and it makes far more game actions than Boros, so it has more clock pressure. Therefore, it sees less play online than in paper. That said, both are clearly the decks that players want to play so these are what the new metagame will be focusing on. And also Frogtide, because Frog players have to play Frog. They've given up on Abhorrent Oculus for good old consistency again.

March Power Metagame

Tracking the metagame in terms of population is standard practice. But how do results actually factor in? Better decks should also have better results. In an effort to measure this, I use a power ranking system in addition to the prevalence list. By doing so, I measure the relative strengths of each deck within the metagame so that a deck that just squeaks into Top 32 isn't valued the same as one that Top 8's. This better reflects metagame potential.

For the MTGO data, points are awarded based on the population of the event. Preliminaries award points based on record (1 for 3 wins, 2 for 4 wins, 3 for 5) if they ever get posted again, and Challenges are scored 3 points for the Top 8, 2 for Top 16, and 1 for Top 32. If I can find them, non-Wizards events will be awarded points the same as Challenges or Preliminaries depending on what the event in question reports/behaves like. Super Qualifiers and similar higher-level events get an extra point and so do other events if they’re over 200 players, with a fifth point for going over 400 players.

Due to paper reporting being inconsistent and frequently full of data gaps compared to MTGO, its points work differently. I award points based on the size of the tournament rather than placement. For events with no reported starting population or up to 32 players, one point is awarded to every deck. Events with 33 players up to 128 players get two points. From 129 players up to 512 players get three. Above 512 is four points, and five points is reserved for Modern Pro Tours. When paper reports more than the Top 8, which is rare, I take all the decks with a winning record or tied for Top 32, whichever is pertinent.

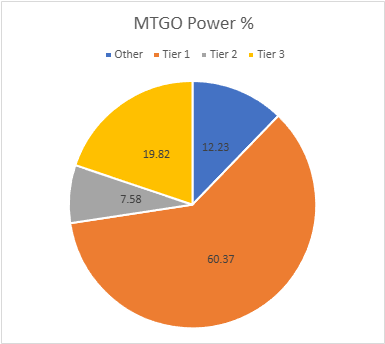

The MTGO Power Tiers

As with the population numbers, total points are down slightly from 2608 to 2584. The adjusted average points were 24.45, therefore 25 points made Tier 3. The adjusted STDev was 48.54, so add 49 to the starting point, and Tier 3 runs to 74 points. Tier 2 starts with 75 points and runs to 124. Tier 1 requires at least 125 points. The Tiers reshuffled a bit and Yawgmoth fell off.

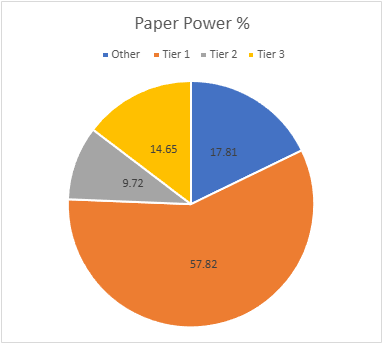

The Paper Power Tiers

Paper's total points are 2437. There were multiple 4-point events to sending the total to new heights. The average points were 26.49, setting the cutoff at 27 points. The STDev was 59.89, so add 60 to the starting point and Tier 3 runs to 87 points. Tier 2 starts with 88 points and runs to 148. Tier 1 requires at least 149 points.

Nothing fell off nor joined the Tier List, it barely even shuffled.

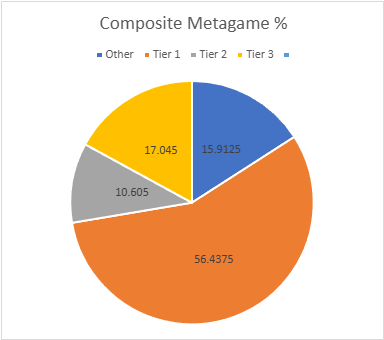

Composite Metagame

That's a lot of data, but what does it all mean? When Modern Nexus was first started, we had a statistical method to combine the MTGO and paper data, but the math of that system doesn't work without big paper events. I tried. Instead, I'm using an averaging system to combine the data. I take the MTGO results and average the tier, then separately average the paper results, then average the paper and MTGO results together for final tier placement.

This generates a lot of partial Tiers. That's not a bug, but a feature. The nuance separates the solidly Tiered decks from the more flexible ones and shows the true relative power differences between the decks. Every deck in the paper and MTGO results is on the table, and when they don't appear in a given category, they're marked N/A. This is treated as a 4 for averaging purposes.

Average Power Rankings

Finally, we come to the average power rankings. These are found by taking the total points earned and dividing them by total decks, to measure points per deck. I use this to measure strength vs. popularity. Measuring deck strength is hard. There is no Wins-Above-Replacement metric for Magic, and I'm not certain that one could be credibly devised. The game is too complex, and even then, power is very contextual.

Using the power rankings helps to show how justified a deck’s popularity is. However, more popular decks will still necessarily earn a lot of points. Therefore, the top tier doesn't move much between population and power and obscures whether its decks really earned their position.

This is where the averaging comes in. Decks that earn a lot of points because they get a lot of results will do worse than decks that win more events, indicating which deck actually performs better.

A higher average indicates lots of high finishes, whereas low averages result from mediocre performances and a high population. Lower-tier decks typically do very well here, likely due to their pilots being enthusiasts. Bear this in mind and be careful about reading too much into these results. However, as a general rule, decks that place above the baseline average are over-performing, and vice versa.

How far above or below that average a deck sits justifies its position on the power tiers. Decks well above baseline are undervalued, while decks well below baseline are very popular, but aren't necessarily good.

The Real Story

When considering the average points, the key is looking at how far off a deck is from the Baseline stat (the overall average of points/population). The closer a deck’s performance to the Baseline, the more likely it is to be performing close to its "true" potential.

A deck that is exactly average would therefore perform exactly as well as expected. The greater the deviation from the average, the more a deck under or over-performs. On the low end, a deck’s placing was mainly due to population rather than power, which suggests it’s overrated. A high-scoring deck is the opposite of this.

I'll begin with the averages for MTGO:

Temur Breach Combo is MTGO Deck of March. It was Deck of the Month for three months running. That it was targeted for banning was completely justified. I just wished it hadn't been killed outright.

Now the paper averages:

Temur Storm Breach just barely pips the Oracle version to become Paper Deck of March. It didn't show up outside of the big events as often as Oracle for some unknown reason. And now it's gone.

Analysis

The big story in March is that at the end of it there was a banning. I don't think there's any argument that the banning was unwarranted. However, I wish there was a way to leave Breach legal while taking the overall deck down a notch.

As I've previously recorded, Breach was Tier 2 at best before Opal was unbanned. However, there was no chance of an Opal reban this quickly, plus Breach has been banned everywhere else. The target it had on its back was too tempting.

The second biggest story is the Deathrite Shaman price spike. I don't know why so many speculators thought it would be unbanned Monday, enough for the price to triple from an average of $3.75 to $13.50 over the weekend. I hope most of them bought before the price really spiked because you'll feel a bath like that, especially since there's no chance of an unban before August. Not that I think it should be unbanned at all, but that's beside the point.

The Ban's Impact

The Grinding Station loop deck we knew is dead. It cannot work at all without Breach. It is possible that there is another, similar deck using something like Song of Creation or Jeskai Ascendancy but it has yet to emerge. There is some minimal splash damage to fringe Prowess and Lotus Field decks but as a whole Modern is unchanged.

Thus, I'd expect that for the next week Modern won't look very different from pre-ban. However, after that things are going to start shifting, potentially dramatically. The Breach matchup required a lot of sideboard slots, slots that can now be used against other decks. Amulet Titan, Belcher, and Ruby Storm are particularly vulnerable to sideboard hate and can now be more directly targeted. However, it also means more slots to fight Blink and Energy.

How that will shake out is impossible to say. Metagames are ecosystems, and removing a link in the food chain affects both prey and competing predators. It may be that the metagame looks exactly the same minus Breach, or it gets completely overturned.

Dragonstorm's Arrival

Another factor is the next Standard set release, Tarkir: Dragonstorm. Ugin, Eye of the Storms looks ridiculous. I will definitely see play in Eldrazi decks and will lead to a revival of Tron. Whether that is a temporary revival, or a permanent one is impossible to say, but for at least a week post-release Tron will be everywhere and competing for space with Eldrazi. Make sure to pack your Consign to Memorys.

The land cycle will also see a lot of speculative play. I'm not convinced that they'll be good enough to beat out other utility land options, but they'll certainly be given a shot. Mistrise Village in particular reads really strong. Giving a spell "Kicker UU: This spell can't be countered" reads really strong for the right deck.

I'm not sure if it will play well. Effects like this tend to be best in combo decks (see also, Boseiju, Who Shelters All), so, unless you're winning with one spell, it's not very efficient.

Financial Implications

Keep an eye on the new cards. Their presale prices are fairly ridiculous at time of writing.

I think that the Eldrazi cards are near their natural equilibrium prices and even if Ugin works out, I don't think the support pieces will see significant price increases. However, Consign and other anti-Eldrazi cards currently have some upward price pressure, so I'd consider looking there for opportunities.

If you bought into the Deathrite hype, hold until the next time Modern's banlist is up for consideration. There's likely to be another speculative bubble and if you want to unload, you should be able to at minimal loss or even profit depending on where you bought in.