Sig has recently accepted the fact that he has a problem: he’s spending too much time on his smartphone, ignoring the world around him. This week, Sig uses Jeremy’s Grab Bag sale as a case study as he explores ways to cut down on time wasted on MTG finance.

Sigmund Ausfresser

In 2012, an interesting Twitter conversation motivated Sig to write a piece on the long-term investment viability of Magic. Looking back at his predictions, Sig is kicking himself as he witnesses the returns he missed by focusing on the stock market rather than the MTG market.

Two readers had valid questions about Sig’s ABUGames arbitrage article from last week. They inspired Sig to do a follow-up piece, where he talks about shipping costs and the brutally honest truth about motivations.

Despite being covered in the past, one of the most frequent questions in the QS Insider Discord is on how to exit ABUGames store credit. Sig is always evolving his strategy with ABUGames, and this week he provides specific updates on how he’s leveraging this buylist arbitrage.

It’s certainly a buyer’s market out there, as prices have pulled back significantly from their highs. But you’ve got to know where to hunt for deals. This week Sig shares three tips on how to find great deals from some of the largest vendors.

Last Friday Sig drove to MagicFest Indianapolis, where he experienced inconsistent results in trying to move some Old School cards. One vendor did come to the rescue, but Sig’s strategy going forward is going to be a little different.

In general, the past few weeks have been fairly dull for Magic finance. But that’s about to change. This week Sig shares three catalysts he thinks will shake up the market and create opportunities to make some money.

Sig wasn’t able to attend MagicFest Las Vegas last weekend. But that doesn’t mean he was disconnected from price trends. This week he examines a particular vendor’s hotlists throughout the event to identify winners and losers.

Sig is planning on attending a Magic Fest next month, where he hopes to sell cards to vendors. But one can’t just jump in blindly and expect to maximize value. This week Sig shares three helpful tips to help you prepare for selling to vendors.

Sometimes a quick flip doesn’t go exactly as Sig plans. In these cases, he follows a strategy to sell these failed specs to maintain liquidity. This week Sig shares his strategies and why he’s often the eager seller.

Recent history has disproved the community hypothesis that Modern Horizons singles had bottomed. Prices on all but the most desirable foils have pulled back considerably from recent highs. Sig ponders whether he should hold or avoid opportunity cost and cash out.

Magic finance and Magic play are two separate hobbies nowadays. They are frequently in tension with each other–an optimal choice in one may be suboptimal in the other. This week Sig reflects on this tension and shares personal anecdotes for how it has impacted his buy/sell decisions.

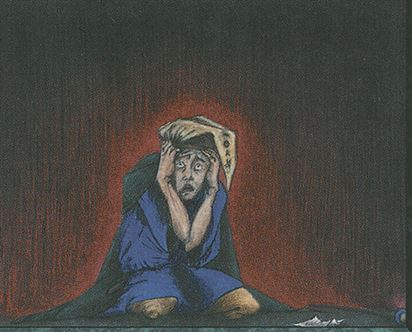

An image of a Faerie appeared on the internet and suddenly everyone in MTG Finance world wants to buy Faerie cards. This behavior can be frustrating, but it can also lose you money if you’re not careful. Sigmund breaks down the case against faeries, and why you shouldn’t give in to the hype.