February reinforced trends from January, and Temur Breach Combo continues its ascent. Evidence shows that other staples remain strong but on a downward trend.

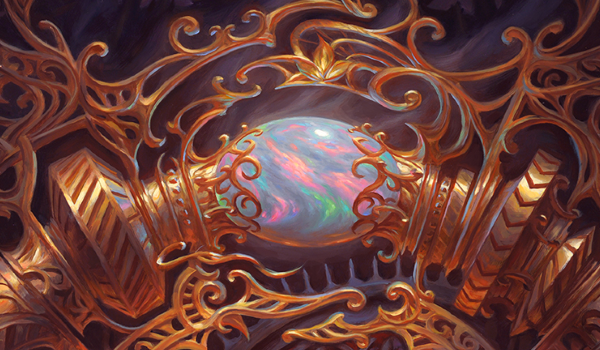

Mox Opal

Despite new decks arising to challenge them, the preban standbys continue to define Modern. New engine cards from Aetherdrift may be enough to dethrone them.

With The One Ring banned and Energy nerfed, Modern is in an experimental phase. However, the data doesn’t reflect this due to MTGO being the only data source.

David E. explores a curious trend among Modern’s top decks: they’re ALL Affinity! Here’s how to beat their strategy of blitzing G1 and powering through hate.

Sig’s records aren’t perfect, but he has recently just passed his 500th MTG finance article–nearly ten years of writing! This week Sig reflects back on his MTG finance journey, the key decisions along the way, and what makes Magic the greatest game in the world.

Modern Horizons 2 is scheduled to be released on June 18, 2021, and the Quiet Speculation team is hyped! Joe takes a look at the highlights from each day of spoilers and helps you prepare for release day.

You may be tempted to walk away from Magic finance during this time of uncertainty. Sig doesn’t think that’s the ideal strategy. This week he shares creative ways he’s engaging in this soft market in order to refresh his collection and maintain liquidity.

Joe shares a story of some financial #feelbads from his MTG hiatus and offers advice on how people in a similar situation can maintain their collections amid bannings without taking too many losses.

Sam’s back from his hiatus to analyze the post-ban landscape! Find out what he’s been up to, and where he finds himself in the current Magic market.

The Pioneer market has slowed down after the Players Tour, but there are still spec targets hiding in this and every other format if you know how to look for them.

It’s a new year, and that calls for an MTGO market check-in! Kyle examines the MTGO Modern market in a post-Mox Opal world, and what cards you’ll want to keep your eye on in Modern’s lull period.

Well, everyone should have seen another ban coming. There was no way that Wizards wasn’t going to let their last scheduled banned and restricted announcement go by without doing something about Oko, Thief of Crowns. However, I didn’t expect it to go this far. Three cards banned would be a fairly substantial shift by itself, […]

At the start of 2019, Sig made three predictions for what the year may bring in MTG finance. Twelve months later, he reflects back on these predictions. The results may surprise you; with greater respect for the unknown, Sig looks ahead to 2020.