Sig investigates eBay’s new vault service and its market implications. What does this service mean for the future of Magic investing?

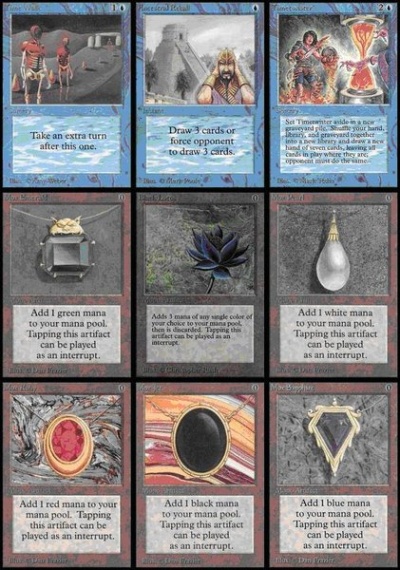

Mox Ruby

Sig’s records aren’t perfect, but he has recently just passed his 500th MTG finance article–nearly ten years of writing! This week Sig reflects back on his MTG finance journey, the key decisions along the way, and what makes Magic the greatest game in the world.

The rise in asset prices and the jump in employment seem paradoxical. This week, Sig takes a look at the economic environment and attempts to explain why asset prices are soaring despite this pandemic, with a look ahead to 2021.

This week, Sig returns to Collectors’ Edition cards, examining how these have responded to recent Reserved List buyouts. Specifically, he points out an interesting gap developing between market pricing and retailer pricing. The trend could make you a little profit.

The COVID-19 pandemic has introduced much uncertainty in the Magic market. However, Sig is seeing a few things that help him feel a little more optimistic. This week, he shares his observations and why he thinks Magic cards remain worthwhile investments.

Modern reprint sets have often led to price increases by sparking newfound interest in the format. Sig explains why Modern Horizons may have an even larger impact on prices this year.

Magic is a hobby riddled with trends and data—sometimes baffling ones. Sig shares three observations that may make sense on the surface, but are perplexing underneath.

This week, Eddie takes a deeper look into how Ravnica Allegiance is starting to affect all formats, along with his resulting portfolio updates.