The COVID-19 government checks are providing cash to players itching to buy Magic cards. But Sig believes Ikoria may the greatest catalysts for MTG finance in quite some time. This week he touches on the numerous formats impacted by this set.

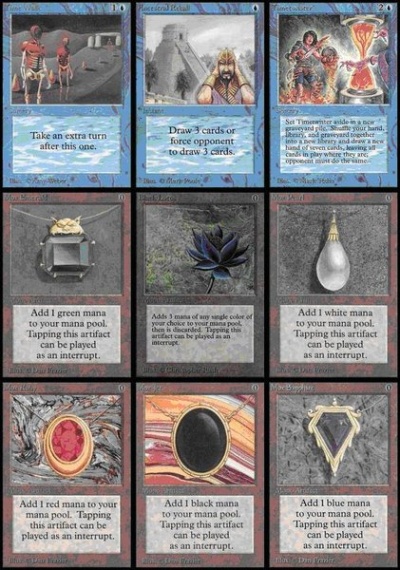

Transmute Artifact

Sig goes off script, eschewing Old School Magic to discuss his experiences learning the value engine of Magic Arena. With a month of play, Sig realizes he may have misplayed with a key deck-building choice, and he wants to help other newcomers avoid the same pitfall.

When people discuss Magic finance, our minds immediately go towards the cards. They are the game pieces, after all, so the game can’t exist without them. However through Magic’s 27 year history, there are a number of ancillary products that can be quite collectible…and valuable.

The glorious days of ABUGames trade credit arbitrage are over! Or are they? While ABUGames has been making significant changes to their grading system and pricing, there may still be deals out there if you know how to avoid the pitfalls.

Despite being covered in the past, one of the most frequent questions in the QS Insider Discord is on how to exit ABUGames store credit. Sig is always evolving his strategy with ABUGames, and this week he provides specific updates on how he’s leveraging this buylist arbitrage.

Check out the first installment of Sigbits Extra, where Sig shares a brief insight into how he’s currently approaching this volatile MTG market.

MTG finance has been on the receiving end of some backlash recently after rampant buyouts catalyzed by Modern Horizons spoilers. But is it deserved? This week Sig examines this nefarious buyout behavior and explains how it could be harming the broader community.

MM17 is a huge hit and Amonkhet is right around the corner. But not everything can be bought blindly—Sig believes there are some real value traps out there.

Sigmund fills in for Tarkan on QS Cast for another discussion on everything Magic finance.