Asset prices are dropping everywhere. Cash is king. This week Sig examines a strategy whereby he’s raising cash from Magic sales to fund investments in other depressed asset classes. The result will be lower Magic prices, so you should be aware of the trend.

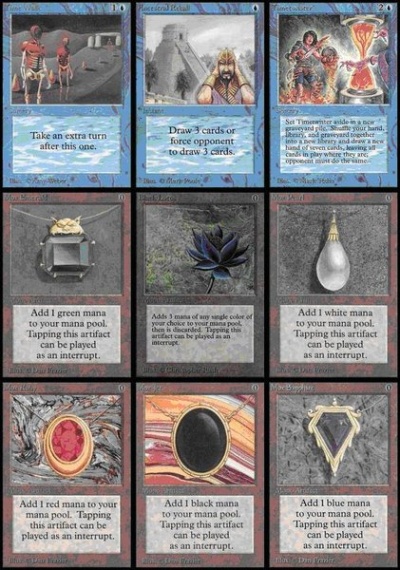

Power 9

Enough warning can never be given when it comes to counterfeits–they will always be a risk to Magic economy’s health. By being more savvy when shopping for high-end cards, and avoiding certain traps, one can avoid much of the counterfeit risk that haunts Magic.

While it’s true the Old School market has been particularly soft this season, some vendors have overdone their price cutting. The result: many deals are out there on major retailer sites…if you know where to look and can catch a restock.

Sig was underwhelmed by last weekend’s Black Friday sales. Some of the discounts simply didn’t create compelling price points. This week Sig shares data to support why these blanket site-wide sales aren’t as great as they’re made out to appear.

Last week, alleged Modern Horizons leaks led to a spike in Flusterstorm. This sparked controversy within the community, with much of the blame falling upon “MTG finance”. This week Sig examines the history of MTG finance and shares his stance on how it does (or doesn’t) impact card prices.

Last week Hasbro’s stock skyrocketed after reporting quarterly earnings. Magic is referenced numerous times throughout. This week Sig digs into the documents, summarizing Magic’s performance as mentioned in the reports.

Modern reprint sets have often led to price increases by sparking newfound interest in the format. Sig explains why Modern Horizons may have an even larger impact on prices this year.